Chainalysis, a crypto asset analysis company, has released the July 2020 to June 2021 version of the Global Crypto Adoption Index, an index that indicates countries with active use of crypto assets. As a result of analyzing purchasing power or individual user transaction volume by country for 154 countries around the world, it was found that the global use of cryptographic assets increased significantly between 2020 and 2021, and that transactions using P2P platforms increased in emerging countries.

The index announced by Chainalysis has been published since 2020 to provide an objective measure of the degree of use of crypto assets. Rather than being influenced by factors such as the country’s own economic situation and institutional investors, it focuses on the use of cryptographic assets for personal transactions and savings by the general public. Therefore, this index has three elements in its calculation.

First, the purchasing power parity weight is the total amount of crypto assets a country has received. This figure can reflect the value of money by country, weighted by purchasing power parity PPP, with the exchange rate based on how much a specific product will be purchased for the total amount of crypto assets received by a given country during the period. In other words, if there are two countries that received $100 in the same period, the country with a lower per capita PPP is considered to have a higher ratio of crypto assets to assets per resident and rises to the top of the index.

Second, the purchasing power parity weight is the amount of personal crypto-asset transaction. The Global Cryptocurrency Adoption Index measures sub-$10,000 crypto asset trades by individuals rather than experts and institutional investors, which incorporates crypto asset trading volume into the index. For this transaction amount, the PPP is also weighted, and the one with the lower PPP amount rises to the top.

Third, the number of Internet users and transaction volume through P2P trading platform weighted by PPP. In many emerging countries that do not have access to centralized exchanges, the majority of crypto asset volume is traded through peer-to-peer trading platforms. Chainalysis measures the P2P transaction volume of crypto assets in each country based on data from two major P2P trading platforms, LocalBitcoins and Paxful, and weights the number of Internet users and PPP.

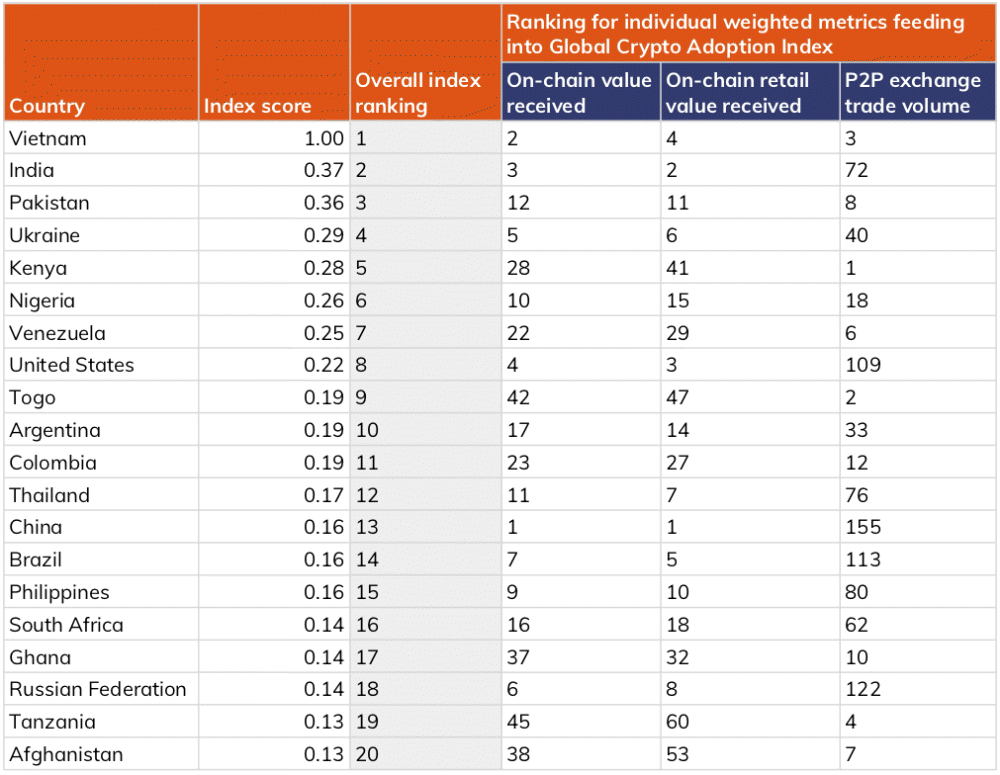

If you look at the top 20 countries in the index calculated using these three statistics, from 1st place, Vietnam, India, Pakistan, Ukraine, Kenya, Nigeria, Venezuela, United States, Togo, Argentina, Colombia, Thailand, China, Brazil, Philippines, South Africa, Ghana , Russia, Tanzania, and Afghanistan, followed by South Asia, Africa, and South America. In addition, based on the index score of 1.00, Vietnam, the first place, India is in the second place with 0.37, and Pakistan is the third place with 0.36.

It is pointed out that Vietnam, which ranks high in all three factors, is one of the best markets for Bitrefill, a company that can purchase gift cards using bitcoin. Aside from their gambling traditions, Chainalysis speculates that Vietnamese people may be the reason why young, tech-savvy people prefer crypto assets to sound investments.

Chainalysis also points out that the use of global crypto assets is surging in the results. The global cryptocurrency adoption index has risen from a score of only 2.5 in the second quarter of 2020 to 24 in the second quarter of 2021, a year later.

Countries such as Kenya, Togo, Vietnam, Tanzania, Venezuela, and Afghanistan, which were listed in the TOP 20, had a huge amount of cryptocurrency trading using P2P trading platforms per person. It is said that there is a movement to protect assets by purchasing crypto assets on P2P trading platforms because cash savings are unstable due to concerns about the devaluation of currencies in emerging countries.

For example, in Argentina, which is ranked in the TOP10, the economic crisis is serious, including repeated currency devaluation, basic hyperinflation, the Corona 19 epidemic, and a three-year recession. In addition, as a result of restrictions on foreign currency purchases due to capital regulations in 2019, crypto assets are attracting attention.

In Afghanistan, which ranked 20th, attention has been focused on Bitcoin since before the Taliban rebels took power in August 2021, and some were turning their assets into Bitcoin. Although Afghanistan is still a cash economy, it is likely that the general public will increasingly use crypto assets as the Taliban invasion has had an impact, such as bank closures.

The global cryptocurrency adoption index is not necessarily a perfect index. Because there is no clear data on P2P transactions in countries subject to sanctions, countries subject to sanctions such as Cuba are often underestimated. Related information can be found here.