Google is a company that provides a variety of services. However, it is known that most of the revenue depends on online advertising. How did online advertising, which is the centerpiece of Google’s business, dominate the market?

Nexstar Media Group, the largest US broadcasting station owner with 197 broadcasting stations under its subsidiary, conducted a test of posting advertisements on the website, excluding the advertising platform provided by Google. As a result, advertising sales plummeted, and in the end, they immediately resumed using the Google advertising service.

Google has great power in ad serving services on the Internet. It is also here that Google and its parent company Alphabet are often investigated by law enforcement agencies such as the US Department of Justice for violating antitrust laws.

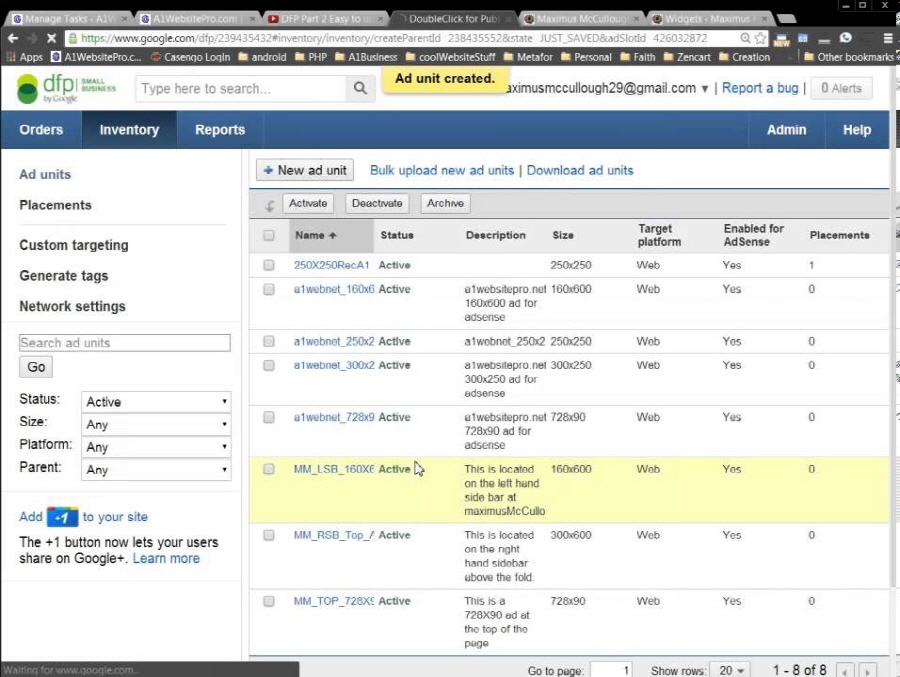

◇ Online ad transaction flow built with DoubleClick for Publisher‧AdX= The reason Google has a strong power as an Internet ad serving platform is due to the company’s DoubleClick technology, which was acquired in 2008. Ad Exchange is what Google has built using this technology.

This is the structure of the ad exchange that Google created with double-click technology. First step 1. Online advertising starts wherever your readers visit your website. In the second step, the publisher who operates the website uses an ad server to sell the website space as an ad inventory to earn revenue and display site advertisements in return. These are the two tools developed by Google. One is DoubleClick for Publishers, an ad delivery server that places ads on website inventory. The other is Ad Exchange, an online exchange system that trades ads in real time between advertisers and publishers.

Step 3. Publishers provide information such as age, income, browsing history, interests and interests of users who visit the website in exchange for using tools such as Google’s Double Creek for Publisher and Ad Exchange.

Step 4. Advertisers can use sophisticated purchasing tools to bid for inventory on Ad Exchange. Advertisers can advertise with pinpoints to customers who want to reach a convincing amount by specifying the type of readership they want to show the ad and the amount of bidding. The sophisticated purchasing tool referred to here is a tool called Display & Video 360 provided by Google.

In the fifth stage, Ad Exchange conducts an inventory auction, and the bidder takes up inventory. Ads can be placed on the inventory of websites provided by the publisher. This is the rough flow of Google’s ad exchange. Voices have been raised that this system should be regulated from before. Senator Elizabeth Warren, who was running for the 2020 U.S. presidential election, made a suggestion that Google’s acquisition of DoubleClick should be resolved.

◇ = Ad Exchange is a reason “Google Ads” The Google Ad Exchange and its associated ad buyers and sellers using the same. Inventory sellers can use Google technology to access demand for more than 700 partners, one of which is Google itself. In addition, buyers can use Ad Exchange to purchase more than 80 inventory. Google says the full interoperability of ad technology can meet the diverse needs of ad sellers and buyers.

In fact, more than 90% of large publishers are found to use DoubleClick for Publisher, an ad delivery server prepared by Google. The reason why so many publishers dare to use Google services is that they have to use DoubleClick for Publishers to fully access Google Ad Exchange. The reason why Ad Exchange holds a special position as an online advertising exchange is the existence of Google Adwords, a Google ad delivery service.

Level 1. Google advertising is at the heart of the Google search business. When a web user searches for a word on Google, it moves on to the next step. Step 2. Ads are displayed along with the search results on the search results page. The advertisements displayed here are determined by auctions conducted by Google Advertising. Advertisers can bid for keyword ads related to search words. For example, you can place advertisements with pinpoints in areas of user interest, such as mortgage. Therefore, it is said to be a fairly popular inventory.

Step 3. As with ads displayed on websites with many Google ads, you can purchase a wide range of ads, including rectangular ads as well as text-based ads. This is the result of making good use of the inventory available in Ad Exchange.

Ad Exchange has been the only way to access the ad exchange market that Google has formed for a long time. Of course, in addition to ad exchange, it is trying to compete with ad exchange by providing a platform called Google advertising. However, according to people familiar with Google advertising products, ad exchange still accounts for the majority of advertising demand.

Because major publishers divide according to the ad demand handled by Google Ads, an executive at a large corporate advertising media sometimes describes the online ad delivery structure as a flaw. News Corporation, the parent company of the Wall Street Journal, which has been criticizing Google for a long time, has reviewed the conversion of its media-owned advertising services from Google to its rival AppNexus. However, Appnexus finally gave up when it came to the conclusion that it could only meet 40-60% of the advertising demand that can be obtained using Google’s online advertising tools.

Likewise, there are many media that review the use of ad delivery services other than Google. For example, Australian daily newspaper Sydney Morning Herald switched from Google advertising service to Appnexus service in 2016. However, the following year, he used Google advertising tools again. In addition, German digital publishing company Axel Springer SE has also changed to Appnexus, but its subsidiary Business Insider continues to use Google advertising services.

Google advertising services, along with similar services from Facebook and Amazon, continue to fight over supremacy in the digital advertising market. According to eMarketer, a market research firm, Google, Facebook, and Amazon account for about 70% of the U.S. digital advertising market. In addition, Google advertising revenue in 2018 was a whopping $116 billion, an increase of 22% from the previous year. It accounts for a whopping 85% of Google’s total revenue.

According to The Wall Street Journal, Google is promoting the use of Google advertising tools by providing incentives for using its tools together. In fact, it is said that a few years ago, selling ads through Ad Exchange canceled certain costs of DoubleClick for Publishers. In addition, Google is integrating two tools, Ad Exchange and DoubleClick for Publisher, into one ad management platform called Google Ad Manager.

◇ Ad Exchange Ad Auction Flow = The website operator sells the empty space of the site as inventory. Google ad server, DoubleClick for Publisher, evaluates ad exchanges in advance, and adopts a system where the highest ranking ad exchanges get bids for inventory. At this time, if the bid price suggested by the ad exchange that obtained the bidding right is the minimum value requested by the publisher, the inventory bid is handed over to the ad exchange that ranks one level lower and repeats this until the next ad bid is decided. However, even if, for example, an ad exchange with a lower ranking is preparing a high bid amount, if an ad exchange with a higher ranking bids more than the minimum bid, the ad range is determined.

Since this is a structure that eliminates a lot of potential profits, Google has developed a feature called dynamic allocation that reserves the ad range. And before inventory bidding by multiple ad exchanges occurs, ad exchanges create a structure in which the haircut is first performed. In addition, Google will enable interoperability among the various advertising tools provided by its company, allowing publishers to check the minimum bid amount entered in other ad exchanges in Ad Exchange. Then, Ad Exchange will be able to offer inventory at the highest amount in the past + $1 for advertisers who want to bid for inventory above the record maximum.

To counter Google’s bidding method, the online advertising industry devised a technique called header bidding. This technology allows multiple ad exchanges to compete for inventory in real-time auctions, but header bidding does not completely eliminate Google’s monopoly, as Google has refused to engage ad exchanges in header bidding, but instead the header bidding winner competes with ad exchange. It becomes a form of doing. The Wall Street Journal appears to be participating in a tournament-style battle, but in fact it is in the same state as it is advancing to the finals from the beginning, raising doubts about its superiority.

◇ Online advertising technology industry is grave = Google has monopolized the market for several years, and not only publishers but also advertising technology companies are losing a lot. In fact, OpenX, Facebook, and Verizon are withdrawing from the ad serving server business that competes with DoubleClick for publishers. One expert also describes the advertising technology industry as a grave.

Since 2016, Google has been asking to use Google advertising tools to purchase YouTube video ads. Google’s monopoly is a momentum that accelerates. Appnexus co-founder Brian O’Kelley said it was the beginning of the end in many respects when Google notified us to use its advertising tools, even ads provided on YouTube. Ari Paparo, who runs the ad bidding service Beeswax, also says that Google has monopolized YouTube ads and expanded its scale as an advertising tool. Related information can be found here.