Corona 19, which has raged around the world since the end of 2019, not only took many lives, but also hurt the economy. There were also delays in roadmaps for each industry due to border closures and banning outings following an emergency declaration. What is the impact of Corona 19 on the semiconductor industry?

TSMC, a Taiwanese semiconductor foundry, produces processors such as Apple, Huawei, and AMD. In May 2020, it signed an agreement with the U.S. government to build a semiconductor production plant for a 5nm manufacturing process in Arizona.

US Secretary of State Mike Pompeo emphasized the agreement that the US will strengthen national security as China tries to dominate high-tech and dominate important industries. There are reports that TSMC has stopped accepting new orders from Chinese company Huawei. It can be said that as a result of the Chinese semiconductor industry, which pursues efficiency and is committed to the principle of comparative advantage, has given up its resilience, it has been exposed not only by global risks such as Corona 19, but also by Huawei export regulations.

Some voices say that the semiconductor industry needs to change about this vulnerability. Some point out on the risk of concentrating production and supply bases in a country. For example, 70% of high purity hydrofluoric acid required for chip production and 90% of photoresist are manufactured by Japan. In 2019, Japan imposed substantial economic sanctions on Korea, and as a result, Samsung Electronics and others were restricted from exporting hydrofluoric acid from Japan, and eventually it was forced to promote the localization of hydrofluoric acid.

The semiconductor industry tends to rely on one company because it requires the skills of a company. Therefore, attracting companies that are more important to your country than other countries will increase supply chain stability. AMD CEO Lisa Su stresses that the US needs a stable supply chain to continue to drive the technology and high-performance computing market.

The American Semiconductor Industry Association SIA, which AMD is also a part of, has given the federal government $5 billion for semiconductor factories, $15 billion for manufacturing facilities, $17 billion for research expenses, $10 billion for basic and applied research, and 50 for new technology centers. It is applying for a billion dollar subsidy. The United States’ attraction of TSMC in the United States is not only seen as a benefit to its own country, but also a paving stone for securing the supply of the U.S. semiconductor industry, which occupies half of the global market share, and the next generation of talent.

Major companies such as Apple and Huawei rely on TSMC, which accounts for almost half of the semiconductor market share in 2019, to produce chips for the latest devices. However, TSMC needs to reduce its dependence in China, which is in conflict with the United States, to build a 5nm manufacturing plant in the United States. TSMC’s rival, Chinese semiconductor foundry SMIC, is expected to see an increase in orders in China, and it was reported in June that it has raised 20 billion yuan in funding and applied for an IPO with the Hong Kong Stock Exchange.

In addition, in the semiconductor industry, each company tends to over-specialize and specialize according to parts or processes. For example, 97% of the global DRAM market is occupied by Korean companies such as Samsung Electronics, SK Hynix, and Micron Technology in the US. If individual companies overtake and hold the share of parts, the interdependence of companies becomes stronger, and if one company has a problem, there is a risk that the impact will spread across the entire industry.

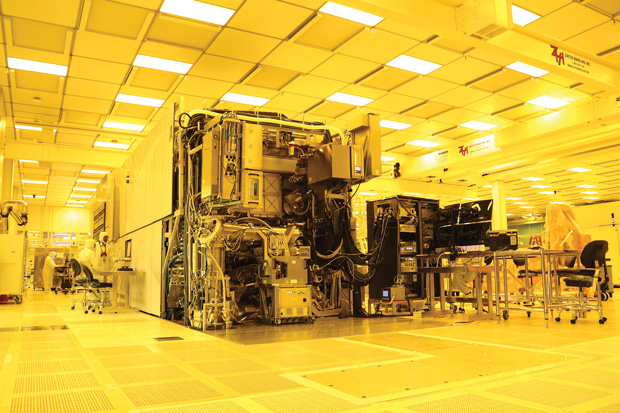

The semiconductor industry is also at risk of business continuity. For example, Dutch company ASML is the world’s largest semiconductor equipment manufacturer with over 80% market share. Since Samsung Electronics and TSMC also rely on it, if ASML equipment shipments are delayed due to Corona 19 or trade friction, there will be a delay in the roadmaps of these companies and a great impact on the global semiconductor manufacturing process.

After the Great East Japan Earthquake in 2011, the Japanese automobile supply chain was forced to overhaul. Fukushima Prefecture, which was affected by the earthquake, produced 60% of the important auto parts in the global market, so each company had to fundamentally review the procurement and production of auto parts. Corona 19 is also having a big impact on the global semiconductor supply chain.

It is pointed out that China and the United States are starting to question that both the government and private companies are too dependent on a small number of companies. As SIA mandated that the semiconductor industry is an important infrastructure for the Trump regime, it is an analysis that a movement to reorganize the semiconductor industry according to the geopolitical strategy in accordance with the Corona 19 epidemic is already beginning. Related information can be found here .