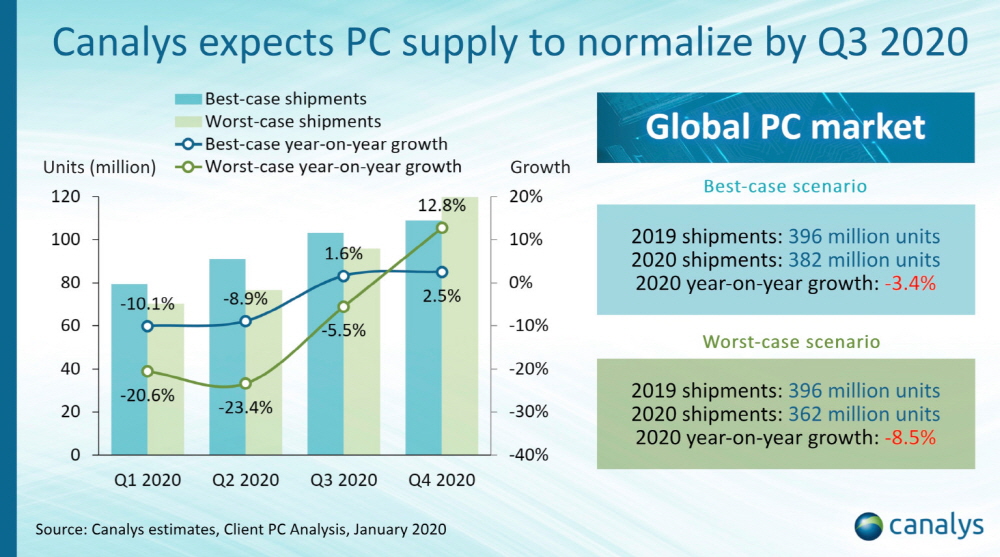

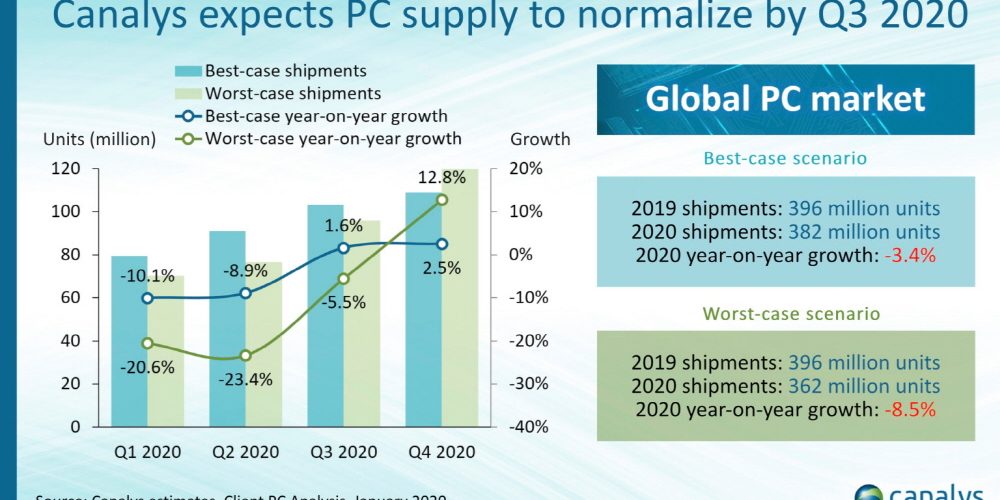

Market research firm Canalys said that the number of PC shipments worldwide in 2020 is likely to decrease by at least 3.3% and as much as 9% due to the novel coronavirus outbreak.

According to the report, the number of PC shipments is predicted to decrease from 10.1% in the first quarter of 2020 to 20.6%. The impact will continue in 2Q, and shipments are expected to decrease from 8.9% to 23.4% in the worst case scenario.

The best scenario is the assumption that even with the novel coronavirus outbreak, 382 million units will be shipped by 2020. This is a 3.4% decrease from 396 million units in 2019. But in the worst-case scenario, the downturn is even bigger, bringing the shipments to 362 million units in 2020. A decrease of 8.5% from 2019.

In the best scenario, production levels are expected to return to full operation by April 2020, so manufacturers will have the strongest impact on agency shipments in the first half of the second quarter, and the market will return to recovery in the third and fourth quarters. have.

Therefore, global PC shipments could remain down 3.4% year-on-year in 2020. Although it declines 10% in 1Q and 9% in 2Q, supply to the PC market will normalize until 3Q. On a yearly basis, it is predicted that after 2021, the global PC market will gradually begin to recover.

In the worst case scenario, it is assumed that production levels do not return to full operation until June 2020. In this scenario, it will take longer for Chinese production and demand levels to recover, and as a result, the second quarter will be affected at a similar level to the first quarter. The market recovery may take until the fourth quarter of 2020.

China, one of the world’s largest PC markets, is most affected by any Sinai. In the worst case scenario, the Chinese market in 2020 will be heavily affected, with a 12% decline from 2019, and it will take a long time to stabilize afterward. The 2021 forecast also estimates 6 million units shipped lower than the best scenario. China’s expected annual growth rate from 2021 to 2024 is 6.3%.

China is a global hub for production and supply chains. In order to contain the impact of the novel coronavirus, the holidays were first extended. Efforts are being made to ensure citizen safety by imposing restrictions on movement. It can’t be helped, but this dramatically reduces offline retail distribution and dramatically reduces consumer purchases.

The novel coronavirus outbreak also leads to a shortage of parts supply. PCBs and memory were lacking not only in China but also in other markets. Likewise, channel partners have also received notifications from two major PC makers, indicating that PC shipments and replacement parts procurement can take up to 14 weeks. This depends on the partner’s location, but three times the normal delivery time.

Technology companies and channel partners in the Asia Pacific region faced unexpected challenges to cope with the sudden epidemic of Corona 19. This crisis was completely unexpected even in mid-January. This trend is affecting many industries such as smartphones, automobiles, TVs, smart speakers, and video game consoles. Foxconn, Apple’s major manufacturer, said on February 20 (local time) that its 2020 sales would be affected by the coronavirus, and factories in India, Vietnam and Mexico are fully operational instead and are planning to expand production in other countries.

Apple announced in early February that it is unlikely to meet its quarterly sales forecasts until March 2020. It is said that the reason is the weak demand due to limited supply of iPhones and the closure of stores in China. Apple is also expected to postpone the production schedule for low-end iPhones. On the other hand, it is expected that inventory of existing models will be out of stock until April or beyond.

Add comment