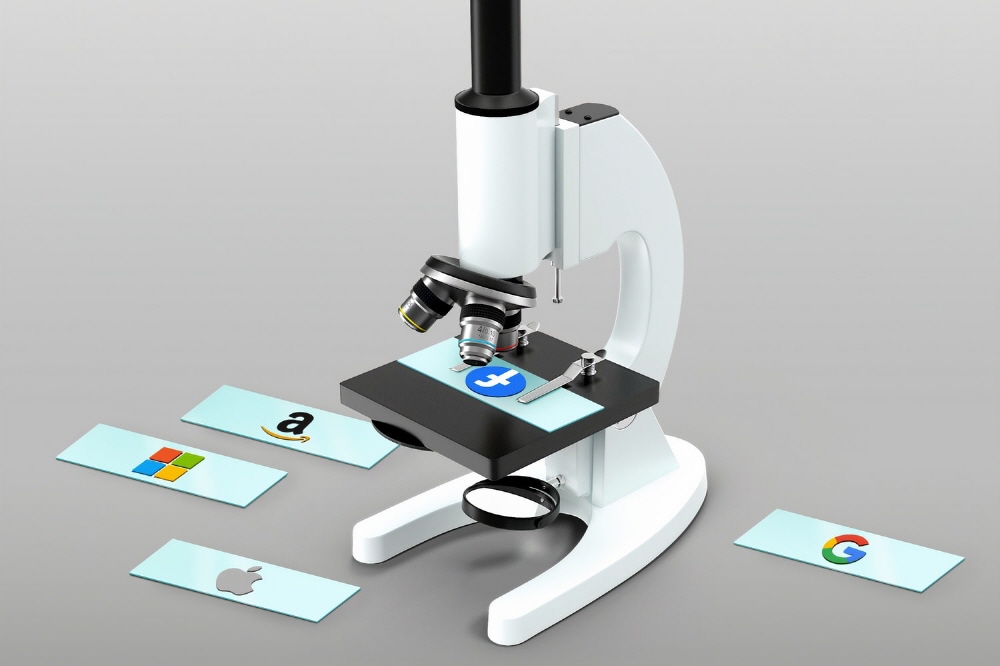

Amazon announced the settlement for the third quarter. Although there was no impact on Amazon Prime Day, total sales increased 37% year-on-year to $96.45 billion, and net profit reached $6.331 million, a 196% increase over the same period last year. In addition, operating profit was $6,194 million, up 96% from the same period last year.

Among them, the North American division has sales of $59.373 billion, operating profit of $2.25 billion, and the overseas division has sales of $25.57 billion and operating profit of $470 million.

This year, due to the large impact of the spread of Corona 19 infection, Amazon Prime Day, which was scheduled to be held in July, was postponed to October. Nevertheless, as the e-commerce business expanded, Amazon’s net profit reached an all-time high of $6.331 million, up 20% from $5.2 billion in the previous quarter. Among the e-commerce businesses, online sales were $48.35 billion, physical store sales were $3,788 billion, and sales of third-party seller services were $24.4 billion.

In addition, AWS (Amazon Web Services) sales, which are the cloud computing sector, accounted for 12.1% of the total, accounting for 11.6 billion dollars, and operating profits of 3.535 billion dollars. Subsequently, the sales of monthly paid subscription services such as Amazon Prime increased 33% year-on-year to $6.572 billion, and the advertising business was $5,398 million, up 51% year-on-year.

CEO Jeff Bezos said that two years ago, Amazon raised the minimum wage to $15 for both full-time and part-time in the U.S., and asked other large companies to take similar measures, and that other large companies such as Best Buy and Target will also raise it to $15. Looking forward to this, he said that now is a golden opportunity. He added that providing employees with industry-leading salaries and excellent medical care is of great significance in this era and is proud to have created more than 400,000 jobs this year alone. In fact, the number of Amazon employees rose 28% from 876,800 in the second quarter of this year to 1.25,300 in the third quarter.

In addition, October to December is the peak season at the end of the year. Amazon expects its fourth quarter sales to reach $12 billion. This is an increase of 8% from the fourth quarter of last year and is expected to grow by 28 to 38% from the third quarter of 2020.

Amazon also pledged to spend more than $4 billion on Corona 19 safety related expenses. Even with a cost of $4 billion, operating profit is expected to reach $3.9 billion in the fourth quarter of 2019 from $1 billion to $4.5 billion in the fourth quarter of this year. Jeff Bezos said that Christmas gifts are being shopped more quickly than ever before, and that this is just one of the harbingers of an unprecedented holiday season. We thanked our employees and partners around the world who are preparing to serve our customers this holiday season. Related information can be found here .

Meanwhile, according to a third-quarter settlement report released by Google parent company Alphabet, sales were $46.1 billion, more than the same period last year.

According to this, sales for the third quarter of Alphabet were $46.73 billion. The second quarter was $38.3 billion and the same period of the previous year was $4,499 billion. The final profit was $1,2274 billion, an increase of 59% over the same period last year.

Looking at the sales breakdown, Google search-related $2,337 billion, YouTube $5,337 billion, for a total of $31.375 billion. In addition, it is $3.44 billion in terms of Google Cloud. Looking at these figures, it can be seen that although various businesses around the world are affected by Corona 19, the alphabet business is working smoothly.

Google CEO Sundar Pichai said it will take two to three years for Alphabet’s investment in hardware to come out, but he is looking forward to a roadmap in the future. Related information can be found here .

In the case of Facebook, according to the third quarter earnings report released on October 29, sales increased by 22% compared to the same period last year. Quarterly sales were $21.47 billion, an increase of 22% year-on-year. As a result, net profit was $78.5 billion, up 29% year-on-year. Advertising boycotts have occurred from a number of companies, but they have nevertheless increased profits.

Facebook also recorded an average of 18.2 billion daily active users on SNS in September 2020, and as of the end of September, monthly active users reached 2.74 billion, all up 12% from the previous year. In a report, Facebook said in a report that advertising revenue in the fourth quarter of 2020 is expected to exceed the growth rate of this report due to the effect of the holiday season, and that Oculus Quest 2 order status is good and other profits are expected to benefit.

In the industry, Facebook’s sales grew by 22% and increased by 12% compared to the same period, which exceeds analyst expectations. However, regarding the earnings outlook for 2021, Facebook said that it continues to face uncertainty and that the effect of COVID-19 is accelerating the transition from offline to online, leading to an increase in ad demand. Considering that online commerce is the company’s largest advertising sector, it is said that such a change in trend could act as a headwind for ad revenue growth in 2021. In addition, in 2021, it is expected that the ad revenue will decrease due to the revision of the iOS14 privacy policy and a headwind from strengthening regulations.

Meanwhile, foreign media pointed out that this quarter, compared to the previous quarter, the number of DAUs in the US decreased from 192 million to 195 million, and Facebook also said in a report that the number of North American users will continue to stagnate or decline in the fourth quarter. I admit it. Related information can be found here .

On the other hand, if you look at Apple, which announced its fourth quarter results from July to September, the iPhone, the flagship product, was not reflected in quarterly sales because its release was delayed from September to October due to the effect of Corona 19. Nevertheless, sales in all product categories other than the iPhone recorded double-digit growth over the same period last year, recording $64.7 billion in sales.

IPhone, the flagship product, accounts for a high percentage of total sales, but the launch was delayed until October, so iPhone 12 sales were not included at all in the fourth quarter. Therefore, iPhone total sales in the fourth quarter decreased by 21% year-on-year to $2.64 billion, and net profit fell 7% to $1.27 billion.

On the other hand, other product categories recorded dramatic sales growth. IPad sales rose 46% year-on-year to $6.8 billion, and Mac sales rose 28% year-on-year to $9 billion. Apple’s service division, which has recently seen huge growth, recorded $14.55 billion, up 16.3% year-on-year, higher than any product category other than the iPhone.

Apple CEO Timcook cited Apple TV+, a subscription streaming service, as a major contributor to the increase in sales in the service sector. While pointing out that the Apple TV+ service started at a similar time compared to Disney+, CEO Tim Cook said positively about the service. However, Apple did not disclose details about the number of Apple TV+ registered users.

Apple also revealed that it is impossible to accurately predict profits in the first quarter of 2021 due to the corona 19 effect. Apple announced four new iPhone models in 2020. The iPhone 12 and Pro are already on sale, and the iPhone 12 Mini and iPhone 12 Pro Max will launch on November 13. Therefore, sales of the new iPhone can be reflected in 1Q earnings.

Due to the delay in the iPhone 12 release until October, Apple’s smartphone shipment share in the fourth quarter fell to the fourth place in the industry, according to IDC, a market research firm. According to IDC, Apple iPhone shipments during the same period were 41.6 million units, down 10.6% from the same period last year. The market share fell from 3rd to 4th in the industry at 11.8%. Meanwhile, Samsung Electronics ranked first in shipments with 80.4 million units and 22.7%, while Huawei’s second place with 51.9 million units, 14.7% and third place Xiaomi 46.5 million units and 13.1%. Related information can be found here .

In addition to these companies, according to the third quarter results released by Twitter, the number of active users per day increased by 29% over the same period last year to 177 million. In the third quarter, it is explained that the investment in Twitter by a large number of advertisers has increased significantly due to active promotion activities such as events and product announcements that have been postponed for a long time due to the effect of Corona 19. Twitter revenues, accordingly, increased by 14% over the same period of the previous year to $966 million.

The number of active users who can generate revenue was 178 million, up 29% year-on-year. In the United States, it increased by 20%, and in the rest of the world, it increased by 32%. Twitter explained that the increase in users can be attributed to the expansion of Corona 19 and the 2020 US presidential election.

Twitter’s user growth is interpreted as a result of continuous product improvement, and user growth is said to be increasing by more than 1 million each quarter. One of the examples of continuous product improvement performance is the mention limiting function implemented in August. More than 15 million tweets have been posted using this feature. Another example is that the option to view the link before the RT opens 33% more articles before the retweet.

Twitter revenue for the third quarter was $966 million, up 14% year-on-year. US sales increased 10% year-on-year to $514 million, and non-US sales increased 18% year-on-year to $432 million. Advertising revenue was $880 million, up 15% year-on-year. Ad demand increased from the end of 2Q to 3Q. In addition, the launch of a new ad-related product developed by Twitter is said to be delayed until 2021 due to the impact of coping with smartphone data privacy requirements.

For other revenue sources, data licensing and other segments, the continued growth of Developer and Enterprise Solutions (DES) led the segment to $128 million, up 5% year-over-year.

Operating profit was $56 million, up 5% year-on-year, accounting for 6% of total sales. The net profit is $29 million, and the net profit ratio is 3%. Related information can be found here .

Add comment