Pixpay is a French startup that tries to provide a means other than cash when parents want to give their children pocket money. Anyone over the age of 10 can create a FixPay account and manage pocket money with a debit card.

Challenger Bank like this is of course not new. For reference, Challenger Bank refers to a new type of banking service characterized by a business model that provides the same services as existing banks such as checking deposits, ordinary deposits, and mortgages through all mobile apps through a banking license.

But most of them are for adults. If you intend to create an account with another Challenger Bank, the applicant must be 18 years of age or older. Some services allow you to create an account over the age of 14 with the consent of a guardian. In contrast, FixPay offers a variety of payment methods as well as cards. Both parents and children download the FixPay app and interact with the service.

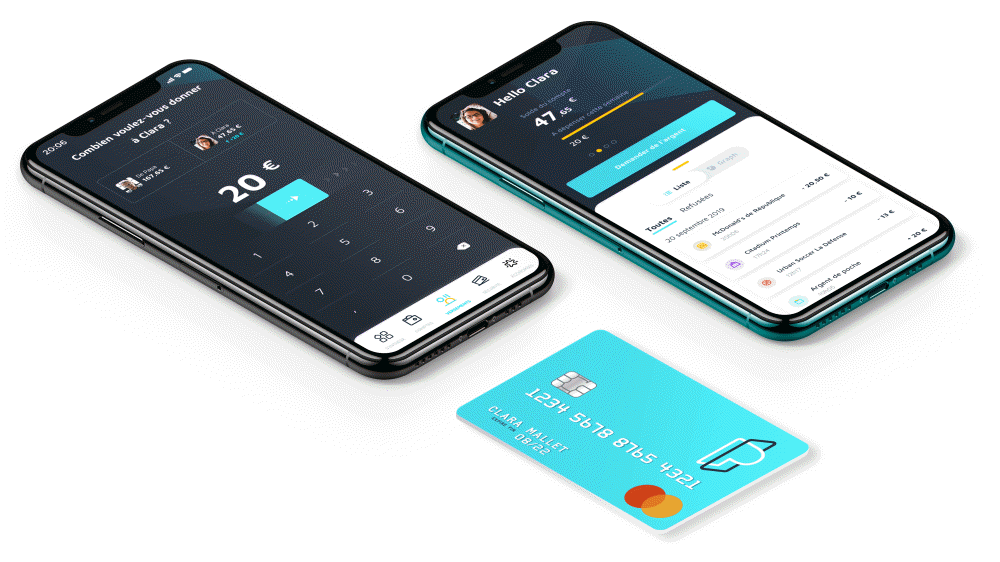

After creating an account, the child receives a Mastercard a few days later. It provides the same function as Challenger Bank. You can customize your PIN code and receive unlocks or transaction-specific notifications. Limits can be imposed on the amount used, ATM withdrawals, online payments or overseas payments. FixPay can also create virtual cards for online payments.

In addition to analyzing your expenses, you can also create a project that sets aside funds so you can continue to save months and buy expensive items. Parents can teach their kids how to save money and set interest rates on their accounts.

Parents can send money directly from the FixPay app, but they can also add funds to their FixPay account from their chosen debit card. You can also send some money to movie tickets and fast food regularly or just once. If you have multiple children using FixPay, parents can check multiple accounts individually. It allows parents to manage their children’s accounts.

The fee for using FixPay is 2.99 euros per card per month. Pay zone payment and ATM withdrawal free of charge, 2% exchange rate fee is charged for foreign currency transactions, and 2 euros additional fee is required for ATM withdrawals outside the Eurozone. The company has raised $3.4 million in funding from Global Founder Capital. It is affiliated with the banking platform Treezor as a service that allows you to create card and e-wallet accounts using the Pixpay API. Related information can be found here .

Add comment