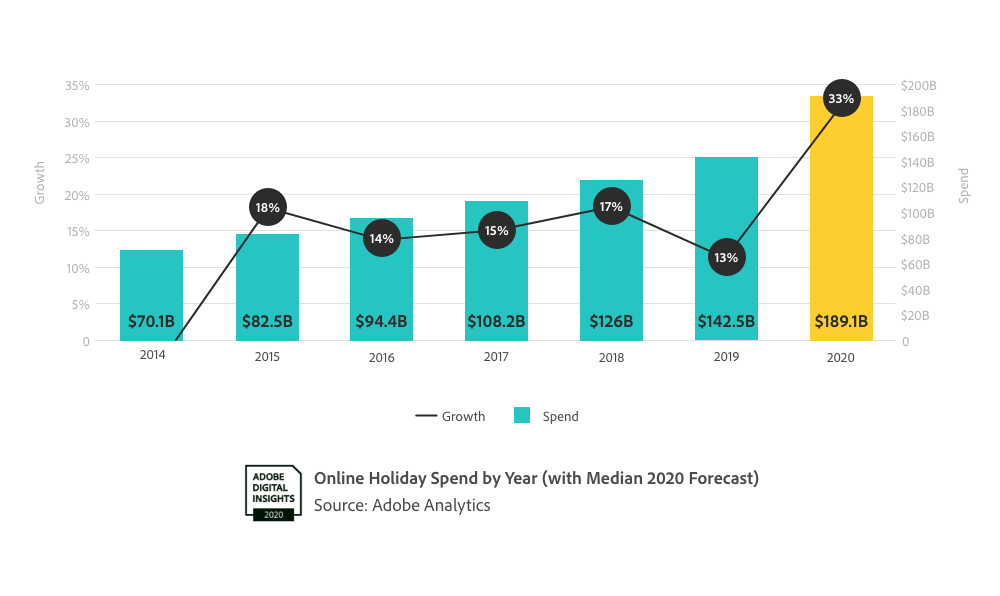

According to predictions released by Adobe Analytics, the rapid change in e-commerce caused by Corona 19 is expected to have a major impact on the US holiday shopping season. Adobe Analytics expects US online sales to reach $188 billion in November and December 2020. This figure is a record high, an increase of 33% over the previous year.

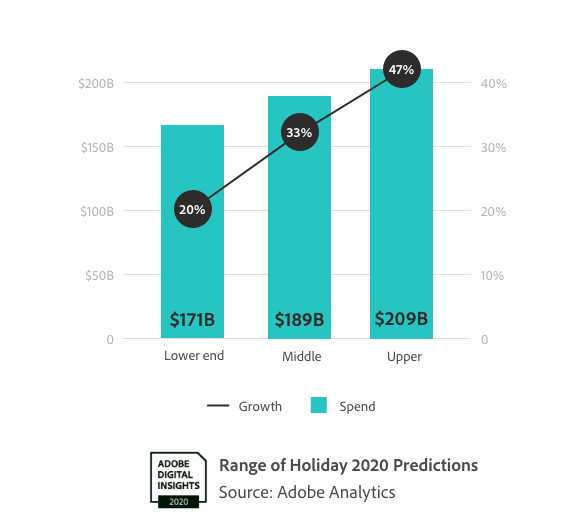

Adobe Analytics pointed out that the sales growth in 2019 was only 13% and predicted that it will achieve two-year growth in one season. Online sales may increase further if consumers benefit from the stimulus package and physical stores close to a wider range in the United States. In this case, consumers are expected to spend an additional $11 billion online, and their total online sales will be $200 billion, up 47% year-on-year.

Consumer shopping methods are also expected to be different from usual. Usually, the online shopping season continues in physical stores. From Black Friday to Cyber Monday, consumers search online for items that could not be purchased cheaply in real stores. Of course, over the years, the boundaries between these individual sales events have blurred. This year, in part, it is expected to follow the flow that starts in the first two weeks of November and continues to Black Friday weekend and Cyber Monday. Adobe Analytics also predicts that online sales will exceed $2 billion every day from November 1st to 21st and will increase to $3 billion a day from November 22nd to December 3rd.

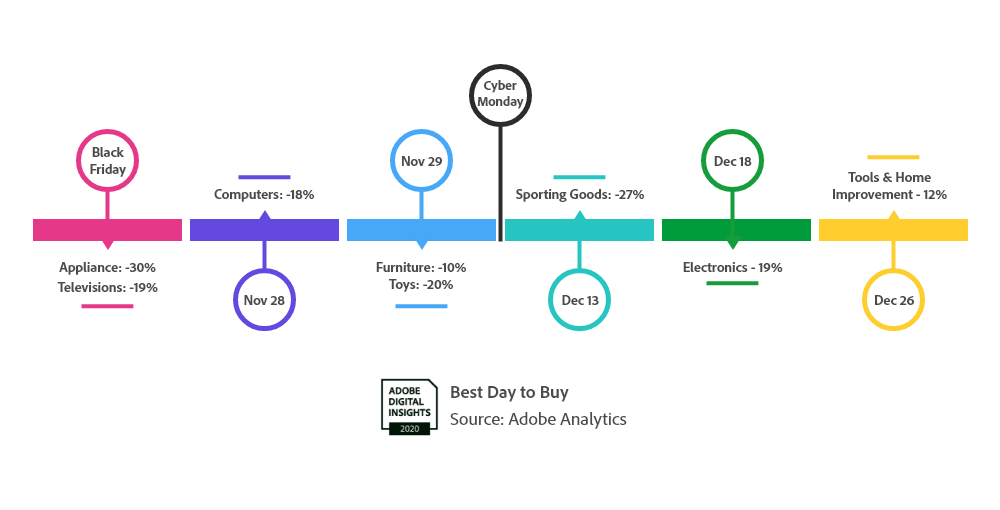

Black Friday online sales increased 39% year-on-year to $10 billion, and Cyber Monday increased by 35% year-on-year to $12.7 billion, and is expected to become the largest online shopping day in the year. For TVs and home appliances, the cheapest event continues until Black Friday, but toy and furniture sales start on November 29, the day before Cyber Monday. In the case of sporting goods, the cheapest sale will be on December 13th and the former will be on December 18th.

As in the past few years, mobile is expected to contribute significantly to e-commerce spending. U.S. consumers are expected to shop on smartphones for $28.1 billion in 2020 from the previous year, a 55% increase. Small retailers also benefit from active online shopping. Online sales are 107%, a significant increase compared to large retailers, and sales of large businesses are up $1 billion from the previous year, up 84% in proportion.

This year, some American consumers are expected to refrain from traveling to meet their families, so Americans who send gifts online to people they would have met in person are expected to spend 18% more than in the previous year.

There is also a strong tendency to pick up items purchased online at stores. Many retailers offer pick-up options and will actually account for half of all orders offered by retail the week before Christmas.

Adobe Analytics predicts that 9% of holiday online small customers will be new customers due to Corona 19. The conversion rate also increases by 13% and sales increase by 33%. However, there is no increase or decrease in the amount per order.

Elections are one of the factors complicating this prediction. Up to now, the year of elections, online sales have been affected by election results. It has decreased by 14% since the 2016 election and 6% since the 2018 midterm election. According to Adobe Analytics, 26% of consumers say election results affect holiday spending. Related information can be found here .

Add comment