Y Combinator has released a 70-page investment guide for attracting investments in Series A. This is an investment attraction guide created based on what Y Combinator has learned while working with 190 companies over the past two years.

Y Combinator launched the Series A program two years ago to help startups that are facing more disadvantages than investors due to information asymmetry. VC is trying to solve the problem of being in an unfavorable position in the process of attracting investment because the startups do not know in detail, although VC understands how to attract Series A.

Y Combinator said, “As we helped start a startup with seed investment, this time we released a guide to solve the information asymmetry problem between startups and investors.” It analyzes dozens of Standard Series A termsheets to create the most fair termsheet, and explains why parallel financing is better than serial financing in terms of financing process and leverage.

The guide contains all the information learned by YCombinator in the process of raising more than 2 billion won by 190 companies over two years. Explaining all the steps a startup should take to successfully attract investment.

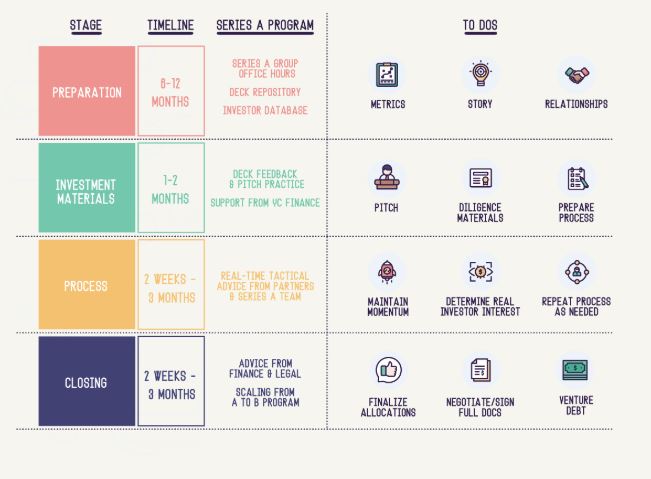

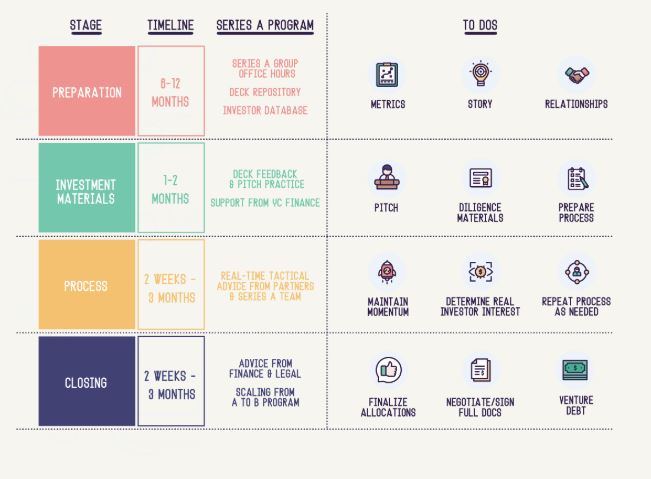

If you look at the guide, you can see that it contains the necessary information and strategies in detail from 6 to 12 months before the investment attraction to the end of the investment attraction. Noteworthy is that it explains the logic behind the investment attraction stage. By explaining the rough thinking process an investor has in the investment process, startups can prepare for investment in a less confused state.

Some of the contents of the guide are as follows.

- Founders meet on average 30 investors to make termsheets

- Founders who choose pre-emptive offers receive a $1 million less investment, while the stock is diluted 1.4% more.

- Comparative benchmarks have little meaning.

Aaron Harris YC Partner, who leads the Series A program, introduced some of the helpful guides to startups through a TechCrunch interview. “Investors request monthly customer analysis data from startups for due diligence,” said Harris Partner. VC calls these customers to confirm, but if they call the customer who is not in a bad mood or the wrong customer, the investment can fly away in an instant. It is important to take steps to ensure that not all call the same customer.”

YCombinator advised, “The guide cannot guarantee the success of the investment, but it can eliminate the fear that may be felt in preparing for a Series A investment, and will reduce mistakes a little.”

Meanwhile, the Series A guide can be found here .

Add comment