China has long been known as a cluster of factories for mining crypto assets, including Bitcoin. However, in May 2021, it was reported that many mining factories were forced to close due to the tightening of regulations on crypto assets promoted by the Chinese government. However, a new University of Cambridge in the UK points out that China’s mining share has declined significantly before the tightening of government regulations.

Since mining crypto assets requires a lot of power, China, where you can get cheap power from coal-fired power or hydroelectric power, is a cluster of mining factories, and its share in global crypto asset mining has exceeded 60%.

However, in May, the Chinese government announced that it would tighten regulations on crypto assets. In fact, as a result of the suspension of acceptance of crypto assets by financial institutions and the ban on mining, Chinese mining operators have been forced to close their businesses. As a result, the price of bitcoin has fallen sharply, and the difficulty of bitcoin mining has been greatly adjusted, which is having an effect such as an increase in the profits of existing bitcoin operators.

In the midst of this, the Cambridge Bitcoin power consumption index, CBECI, released by the University of Cambridge, was updated and China’s mining share had declined significantly before government regulations were tightened. CBECI is an independent platform that provides information and insight into electricity consumers by mining against the backdrop of growing concerns about bitcoin mining sustainability and environmental impact.

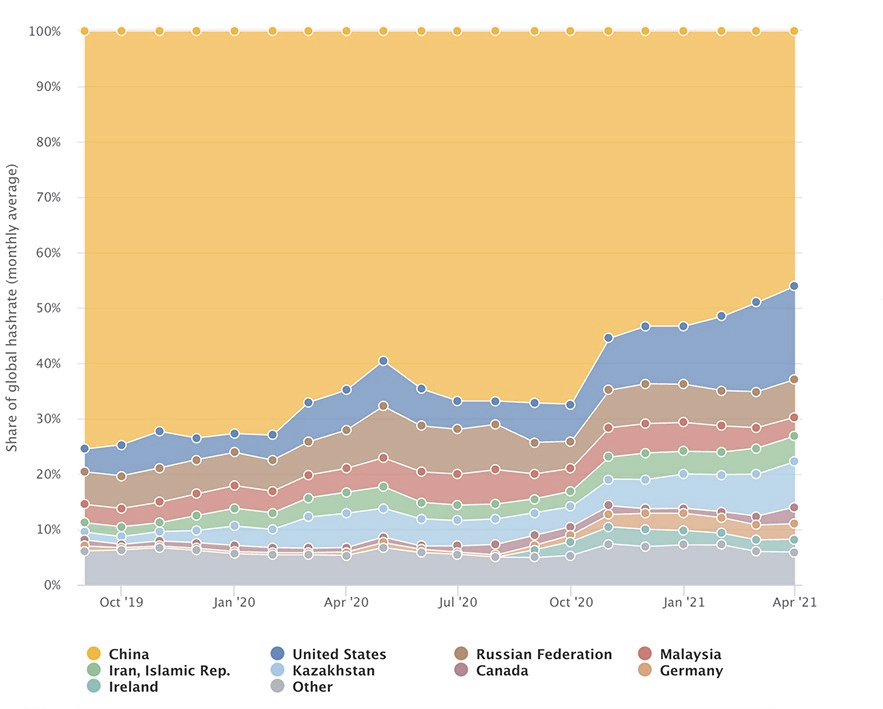

If you look at the hash rate ratios of each country from September 2019 to April 2021 calculated by CBECI, as of September 2019, China accounted for 75.5% of the global hash rate, but the ratio started to decrease in 2020 and It fell below 60% from March and fell to 46% on April 21, 2021. This shows that the mining share was declining even before the Chinese government regulation began in earnest. During the same period, the U.S. share rose from 4.1% to 16.8%, ranking second in the world, while Kazakhstan, which has abundant fuel resources, increased from 1.4% to 8.2% and ranked third in the world. As of April 2021, Russia ranks 4th with 6.8% and Iran ranks 5th with 4.6%.

CBECI also partnered with four mining pools (BTC.com, Poolin, ViaBTC, and Foundry) where several operators cooperate to mine and received data. The dataset they provided accounts for 37% of the total computing power of the Bitcoin network, and is said to be able to reveal geographic details about mining.

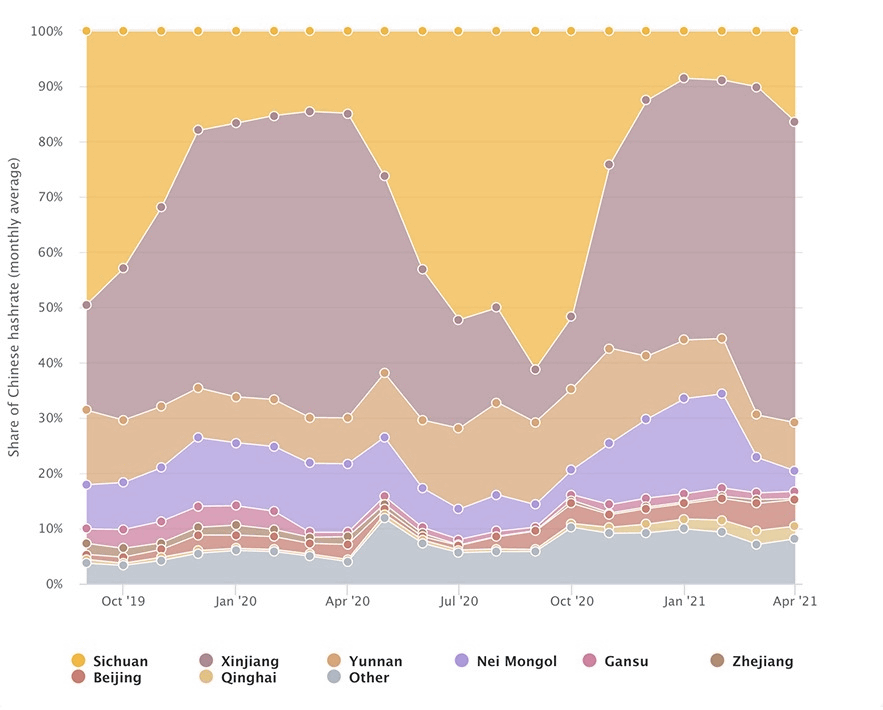

According to the trend of China’s mining share from September 2019 to April 2021, it shows that in the case of Sichuan, located in southern China, and Xinjiang, in the northwest, close to Central Asia, mining operators moved according to the wet and dry seasons. In Sichuan, during the dry season from October to April, mining operators move to Xinjiang Uyghur Autonomous Region because they use cheap electricity generated from coal-fired power plants. On the other hand, from May to September, when Sacheon is the rainy season, it moves to Sacheon, which requires cheap electricity produced by hydroelectric power.

The seasonal movement patterns of Chinese miners are known, but this is the first time they have actually been confirmed with data. However, the pattern identified this time will disappear in the future as mining is banned in major areas such as Xinjiang and Sichuan due to tightened regulations by the Chinese government. Related information can be found here.

Add comment