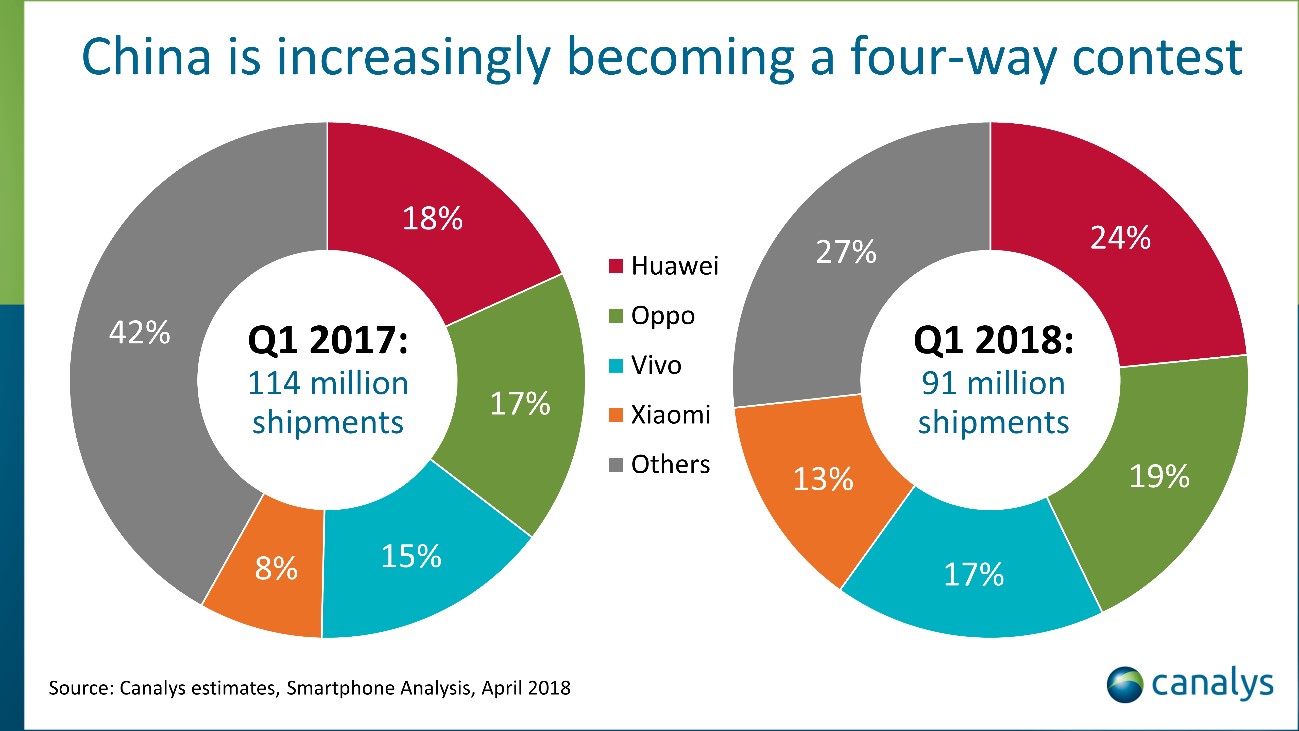

Smartphone sales in China are on the decline. According to market researcher Canalys , sales of smartphones in China fell 21% in the first quarter of this year. The Chinese market, which has been leading the global smartphone market so far, has peaked. The reasons for the decline in smartphone sales are various reasons such as increasing penetration rate or lack of innovative technological progress.

As the Chinese market shrinks, the importance of the Indian market naturally emerges. It is the second largest market in the world after China. China, as well as advanced countries with high penetration rates, are entering the saturation phase and are attracting attention as promising markets. India has the world’s second largest population of 1.3 billion, and smartphones are still in the market. Demand for smartphones is expected to increase in the next few years.

In July, there were 42 smartphones launched in India. Considering that it was 25 households in the same period last year, it can be seen that the smartphone competition in India is becoming more and more intense. Four of the TOP5 smartphone sales in the Indian market are Chinese manufacturers. Apart from Samsung Electronics, Chinese smartphone is occupying.

Of course, Samsung Electronics has been in the top position in the Indian market for a long time. However, SEC’s share of the smartphone market in India has dropped to 24%. Last year, China Xiaomi topped the list with 29.7%, followed by Bibo with 12.6%, Oppo with 7.6%, and Tencent with 5%.

Chinese products accounted for two-thirds of the Indian smartphone market. But until three years ago, China’s market share was less than 15 percent. At the time, the Indian market was dominated by local companies such as Micromax in addition to Samsung Electronics. However, this change in the airflow is the result of a sudden change in the mobile line in India.

Mukesh Ambani, an Indian businessman in 2016, has launched Reliance Jio services in India to set up a broadband network in India.

Until then, few public Wi-Fi hotspots were available for free in India. I could not access the internet because the infrastructure was not equipped in the rural areas. Of the total population, only one out of every five people have access to the Internet. Mukesh Ambani plans to build 4G high-speed wireless communications at low prices through Reliance Geo Service to build an Internet network all over India.

Reliance Geo has already set up a 4G wireless network in 80% of India in 2016. Mukesh Ambani predicts a digital revolution across India and will cover mobile networks in 18,000 cities and 200,000 villages in 2016 and cover 90% of the population by next year Announced. There is also a prospect that Internet services in India will undergo dramatic changes due to the price hurdles.

However, Reliance Geo began offering 4G communication services that could be called price disruption, but it took time for Indian smartphone makers to launch an affordable 4G smartphone that consumers can afford to buy. It is Chinese smartphone maker that has entered such a niche. Indian makers, such as Mike Max, who had a strong presence in the market with 46% of the market in 2016, started to get out of the market and slumped toward Chinese makers to make it more difficult to recover.

The quick response to India ‘s policy changes is also one of the factors that boosted Chinese makers’ market share. In 2014, the government of India will announce the Make in India program. For the purpose of promoting foreign investment to improve the share of Indian manufacturing GDP. To this end, we have given tax incentives to companies producing products in India.

It is Xiaomida that responded quickly to this policy. In 2018, Xiaomi has a smartphone manufacturing plant in India, employing more than 10,000 people, and has set up a base for manufacturing smartphones for sale in India. In addition, 95% of the workforce employed by Xiaomi in India is female, helping to narrow the gender gap in employment.

https://youtu.be/D1TwE8BjBms

For the same reason, Samsung Electronics also opened the world ‘s largest smartphone factory in India this year. Samsung Electronics has built a smartphone manufacturing plant in Noida, India, but expanded the plant by adding 130,000 people to its neighboring sites. Samsung Electronics plans to increase its smartphone output in India by 2020. The Noida factory’s smartphone production volume is expected to increase from 68 million units to 120 million units by 2017.

India’s smartphone shipments in 2017 are 124 million. Shipments increased by 14% YoY. The number of smartphone users in India is estimated at 425 million as of last year. However, as India has 1.3 billion people, it is expected to grow.

Samsung Electronics has announced that it will manufacture all models, including flagship models, as well as low-end smartphones for under $ 100 at the Noida factory. In addition to low-end models, which are the mainstream in the Indian market, the company will manufacture smartphones of all price ranges from high-end models to respond to changes in domestic demand in the future.

When it comes back to China, Samsung Electronics is doing the same for India, but Xiao Mei also expects explosive growth of the Indian market and plans to build three more factories in India. Direct mass production of smart phones in the vast Indian market will inevitably help deliver smartphones at low cost. Xiaomi announces the Poco F1, a high-performance low-cost smartphone in India, that takes advantage of the low-cost Indian labor force while enjoying tax benefits. The Snapdragon 845 uses 6GB of RAM and UFS 2.1 storage, but the price is only Rs 29,999. It was able to offer an overwhelming price / performance ratio.

For this reason, Apple has not been able to reach the Indian market for a long time. Apple is considering measures to resell the iPhone 4 that it has already stopped selling, or to turn it into a relatively inexpensive iPhone SE in India. However, the premium smartphone still does not grow in the Indian market. Moreover, as high-performance, low-cost smartphones such as One Plus quickly gained popularity in the Indian market, Apple is losing its presence in the premium market.

Indeed, the average national salary in India is still low. As a result, demand for low-end smartphones under $ 250 is mostly in demand. Apple smartphones are more than $ 500, so it’s natural that Apple’s presence is blurred in the Indian market.

Indeed, in 2014, Apple denied reports that local media in India would resell the iPhone 4 in India, but ultimately decided to resell the iPhone 4 8GB model to Rs 23,000 in the Indian market. At the time, models such as the latest model, the iPhone 5s and the low-cost iPhone 5c, were out of favor for the Indian market. In comparison, it is resold because of the demand for cheap iPhone 4. In fact, Apple had a market share of 4% in the period from October to December 2012, but its share in the first quarter plummeted to 1.4% in 2013. In the same period, Samsung Electronics increased its market share from 33% to 42%. This nervousness brought back the model four years ago at that time, but it did not bring back the declining share.

Until now, Chinese smartphone manufacturers have been subcontracted by design and manufacturing from Indian manufacturers. However, after subcontracting manufacturing, it became clear that it was possible to know the tastes of the Indians and eventually they decided to sell them directly, and succeeded in reducing the additional cost, and it was no longer possible for the Indian company to get rid of it. In addition, it develops and sells superior products that are able to sweep the Indian market, which is very competitive in price, and it is helping not only the huge Indian market share but also the global sales strategy. For example, the rapid growth of the Indian market has resulted in a great success in the African market.

With the Chinese market in full swing, India is gaining attention as the most promising market. China’s smartphone penetration in the Indian market is a sign that the Chinese presence will increase in the global market.

Add comment