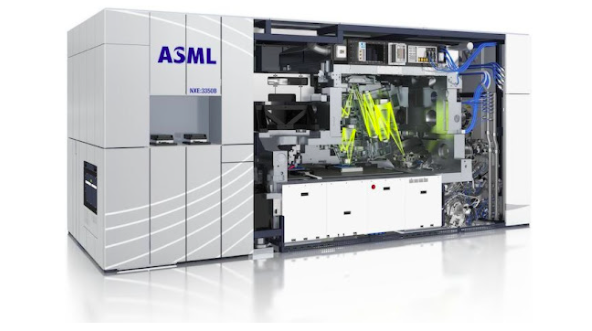

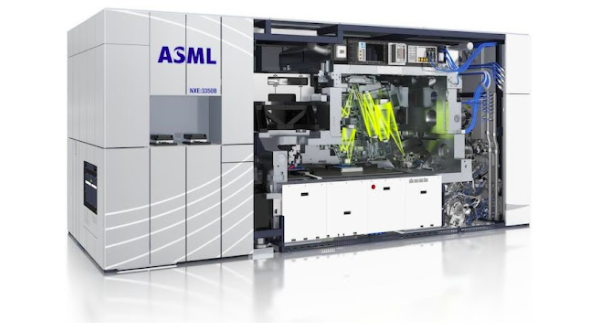

The semiconductor shortage is worsening, with the lead time from ordering semiconductors to delivery taking more than 20 weeks. In order to produce advanced semiconductors, EUV, an expensive manufacturing device of more than 160 billion won per unit, is required, but the supply of EUV equipment is almost monopolized by a Dutch company called ASML, which has a market cap of more than 300 trillion won. What kind of company is ASML?

ASML’s main product is extreme ultraviolet lithography EUV equipment that uses advanced optical technology to print small circuits on silicon wafers. EUV equipment production is about 50 units per year, and ASML has almost a monopoly on the technology.

ASML’s main customers are semiconductor companies such as Intel, Samsung Electronics, and TSMC, and as computing continues to evolve according to Moore’s Law, EUV is needed. ASML sold $16 billion worth in 2020.

ASML was established in 1984 as a joint venture between Philips and ASM International. The first product was the PA2000 stepper, a semiconductor exposure machine that projects a silicon design. However, semiconductor exposure machines were lagging behind Japanese rivals Nikon and Canon. In 1990, ASML dissolved its capital relationship with its parent company and established itself as an independent company.

ASML’s first hit product appeared in 1991. Driven by this momentum, ASML went public in 1995. After the listing, it acquired a number of US lithography companies, occupying a market share similar to that of Nikon and Canon in the late 1990s. ASML goes one step further here and makes big bets.

As a first bet, ASML developed the TWINSCAN system using immersion lithography in 2006. Immersion exposure is a technology that uses water as a lens to shorten the laser wavelength and increase the chip circuit. The TwinScan was ASML’s first high-end product.

In the mid-2000s ASML invested heavily in the development of EUV technology. Investing in EUV technology was a huge risk because EUV lithography would require Samsung Electronics, Intel, and TSMC to completely redesign and rebuild their factories. ASML invested $5 billion in EUV technology research from 2008 to 2014.

The science necessary for EUV technology was established in the 1980s thanks to the efforts led by the US by the US Department of Energy and companies such as AMD, IBM, and Intel. And ASML acquired the license in 1999. In comparison, Canon decided not to pursue EUV for financial reasons, while Nikon chose to refine its existing technology.

Since the possibility of EUV was very high, companies such as Intel, Samsung Electronics and TSMC jointly acquired a 23% stake in ASML. Intel, the largest stakeholder, received 15% at €25 billion. Most of the shares acquired at this time have already been sold. The first commercial EUV products were launched in 2016.

ASML plays a similar role to Boeing, an airline that handles products worth more than 100 billion won, and is integrating 4,750 global high-value-added parts suppliers, including American factory machinery, Japanese chemicals, and German lenses.

Since ASML can only produce 50 EUVs per year, it is difficult to adjust the supply first, it is customizable for each device, and more than 30 variables can be selected. It is said that the reason is that it is long.

Delivery is also that each EUV weighs 180 tons, disassembled EUV uses 40 containers, transport requires 20 trucks and 3 Boeing 747s, ASML team must be on-site for management and to accommodate EUV, minimum We need billions of dollars.

As of 2021, ASML has a 90% share in EUV and deep UV semiconductor lithography. In the semiconductor field, more than $120 billion in facility investment is expected every year, so the EUV tailwind is expected to continue, including growth in major sectors such as automobiles and conversion to 5nm manufacturing processes that require more EUV.

Although sales of EUV equipment itself are slow, the ASML business maintains system maintenance and migration upgrades. ASML machines have the potential to reach 50% of the machine’s price in service-based sales over a 20-year lifespan.

Since chips are needed in all fields such as data centers, AI, automobiles, and mining, semiconductors can be said to be the crude oil of the 21st century. The chances of hearing the name of ASML, which has grown to a trillion-dollar company, will increase as the tech Cold War heats up enough to bar the US from exporting EUV-licensed technology from the Netherlands to China. Related information can be found here.

A tin droplet drops into a vacuum

A tin droplet drops into a vacuum

Add comment