Semiconductor supply in the first quarter of 2021 was far below demand, and on March 17, 2021, CEO Dong-jin Ko of Samsung Electronics said that there was a serious shortage of semiconductors around the world. An analysis of the cause of such a global shortage of semiconductors is drawing attention.

As reported by Susquehanna International Group, the average of chip order and delivery period and lead time from 2017 to 2021 shows that it has been getting longer since November 2019, but it has grown rapidly in 2021 and has grown rapidly in February 2021. It reached an average of 15 weeks. In response, the global semiconductor shortage is expected to continue until the end of 2021 or 2022.

The analysis cited the increase in demand for semiconductors as the cause of the global shortage of semiconductors. Summarizing the semiconductor trend from 2010 to 2020, semiconductor sales are on the rise. In addition, semiconductor sales in the automotive sector are increasing. According to market research firm IHS Market, the cost of semiconductors accounted for 18% of the production cost of automobiles produced in 2000. Since then, the share of semiconductor costs will increase, and it is expected to reach 40% in 2020 and 45% in 2030.

In automobiles and home appliances, low-cost semiconductors are used. However, it is pointed out that the semiconductor supply shortage has fallen because the increase in low-cost semiconductor production facilities does not keep up with the increase in demand.

In addition to this increase in demand, the Corona 19 epidemic is also affecting the global semiconductor shortage. The spread of Corona 19 has created uncertainty in the market. In addition, it failed to secure semiconductors because it underestimated the amount of semiconductors required for automobile production. As a result, the automotive industry is expected to miss $61 billion in sales in 2021 alone.

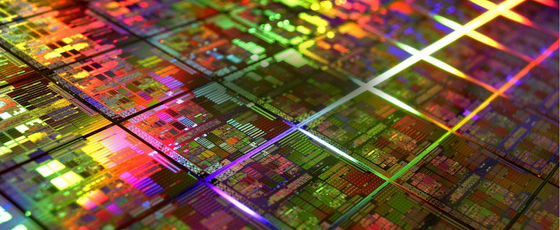

In terms of semiconductor foundry market share, TSMC 12.9 trillion, Samsung Electronics 4 trillion, UMC 1.6 trillion, Global Foundry 1.5 trillion, and SMIC 1.1 trillion. The world’s largest foundry is TSMC headquartered in Taiwan, with Samsung Electronics in second place, and UMC, a Chinese company, all located in Asia. In addition, products such as photolithography equipment, chemical products, and electronic design software, which are essential for semiconductor manufacturing, are monopolized by some companies such as ASML, Shin-Etsu Chemical Industries, and Cadence Design Systems.

Of course, some point out that this phenomenon in which regions and companies are in charge of semiconductor manufacturing can become a bottleneck in semiconductor production. In this regard, IDM2.0, an expansion strategy for foundry services announced by Intel on March 23, 2021, shows expectations that it will be able to restore the independence of US semiconductor manufacturing. Related information can be found here.

Add comment