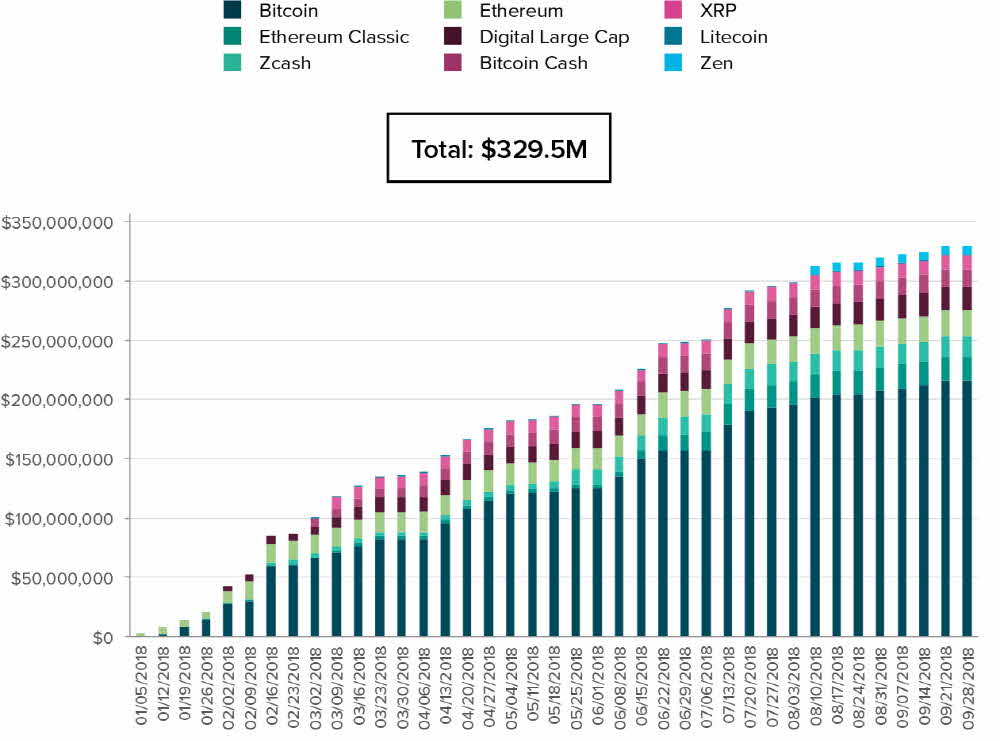

In the third quarter, cigarette money giant Grayscale’s cigarette money investment was $ 81.1 million, up 33 percent from the previous quarter. Fund inflows this year amounted to $ 333 million, 13 times higher than in the same period last year, the highest since five years ago. The results were seen in a third quarter investment report released on November 1 (local time).

According to the report, the cryptographic market was weak overall this year, but in the case of Grayscale, Grayscale is offering 9 cryptographic products, with GBTC, which relies on bit coin pricing, to record a 73% share of the third quarter. In the third quarter, the average investment per share was $ 6.2 million and the GBTC was $ 4.5 million, with 70% of the investment being institutional investors.

Bitcoin is trading at $ 6,355 this year, down 55 percent from this year. Greyscale explains that the slump in the cryptographic market is a good opportunity for new entrants. He also pointed out that investors do not have to tell the fundamentals of bit coins, but are concerned with quotas, scaling issues, and transaction growth. For more information, please click here .

Add comment