Oct. 31 (local time) Satoshi Nakamoto writes bit coin paper and celebrates 10 years. Of course, as it is well known, Bitcoin has maintained its reputation as the most famous cipher for the past decade. During this period, there were many twists and turns and episodes. The first and most memorable event is Bitcoin pizza day. On May 22, 2010, a programmer, Laszlo Hanyecz, bought a second copy of Papa John’s Pizza for a 10,000-bit coin. Historically, cryptography has been known to be the first use of commodity settlement.

He is paying 10,000 BTC at Bitcointalk.org and is asking for a second pizza delivery. Eventually, in four days, a user who uses the name jercos will deliver a second copy of Papa John’s Pizza. Of course, at that time, the value of 1BTC was only $ 0.0041. It was only $ 41 for 10,000 Btc.

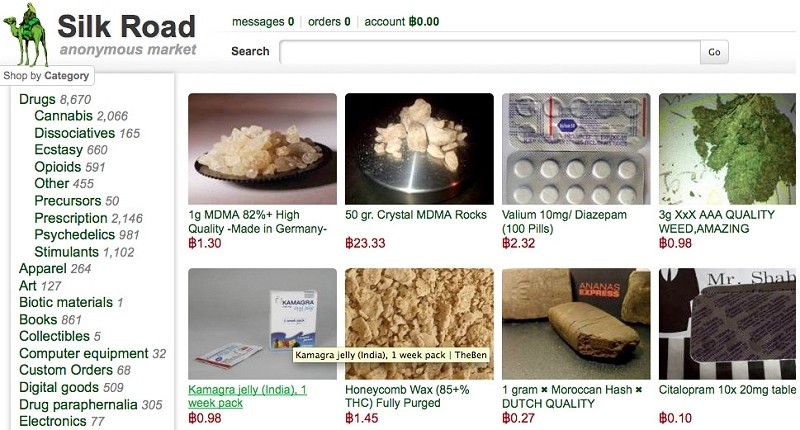

Silk Road is also a must. Silk Road was born in 2011 and by March 2013 was a black market site selling 10,000 products. 70% of the goods sold were drugs. It was Bitcoin that became the keynote of the Silk Road, which was the largest on the dark web. It was welcomed by the black market because it could neatly hide the evidence of money that was exchanged directly without having to go through a bank or credit card company. Bitcoin, which started at pizza, played a full-fledged role, but Silk Road, which was operated through Tor, an inability to track traffic, was useful for criminals to exchange illegal goods.

In the end, the authorities could not leave the Silk Road, and the Silk Road will be closed by the FBI in October 2013 as the incident progresses. Founder Ross William Ulbricht was also arrested. He was sentenced to life imprisonment in parole in 2015.

In 2014, things will happen again. At the time, Mt.Gox, the world’s largest cryptographic exchange, was hacked and broke. Hacking says that a total of 850,000 BTC have disappeared.

For this reason, in front of Mt. Songs’ office in Tokyo, Japan, he was shocked by the victim who was carrying his placard and asking for his bit coin. At the time of Mark Karpeles, many reporters gathered at the CEO’s press conference, and the case of Hacking Mounts aired annually. Negative events led to the success of cryptography.

In fact, four years later, the case of Mounts was not over yet. The world ‘s largest cryptographic exchange has been hacked, but bit coin prices have been recovering for some time on low flights and are well – known to record highs in 2017. Mount Co., Ltd., A subsidiary of the Tokyo District Court, has been involved in the bankruptcy process. The change from bankruptcy to regeneration is the first case in Japan.

The current problem is the bit coin situation method. Debates continue to be debated among creditors whether to repay with bit coin or with a bit coin cache that was born as a hard fork, or to pay back in court currency.

The remaining 200,000 BTC coins on Mounts. Bankruptcy officials announced in September that they sold Bitcoin and Bitcoin Cache worth W260bn for four months from April this year. The review of the civil rehabilitation plan of Mount Songs is scheduled to end in February next year.

Another news is hard fork. It can be said that it is an important watershed in the greeting. The beginning of the event on August 1 last year comes at a time when there is a controversy over how to solve the scalability problem of bit coin, such as whether to compress data or increase block size.

When the compromise did not take place in this process, the Chinese cryptographic mining company ViaBTC (ViaBTC) led the hard fork and the result was Bitcoin Cache.

At that time, the two coexisted around the introduction of SegWit2X to expand the block size, compressing the transaction to increase the amount of transactions per block. Segwitt 2X simply means to double the block chain processing capacity. There is a confrontation between the groups that support Segwit 2x and the opposing groups for reasons such as vulnerabilities. Then, in November last year, the Segwitt 2x supporters announced that they would stop the hard fork for the introduction of Segwitt 2x, which was scheduled for mid-November. With this announcement, bitcoin prices rose to close to $ 8,000, turning to a December high.

Bitcoin will shoot $ 20,000 on December 17 last year. It was a gathering of topics with a sharp rise of 2,000%. Expectations surged ahead of a month after the start of a bit coin futures trading at the Chicago Mercantile Exchange. In Korea as well as in the US, there has been a bitcoin trade boom, and in the App Store, coin – related apps have climbed to the top of the rankings.

After this peak, however, the bit coin starts to fall. It has fallen 65 percent this year and is currently in a stalemate over $ 6,500. The stock market is still lower than the Nasdaq and the S & P 500.

While institutional investors such as Fidelity are continuing to enter, passwords are not responding. In the meantime, the beat coin is hit by 10 stones, and it is expected that the market will turn around again.

A bit earlier this year, October 31, the beat coin was $ 6,400. In November, it started to rise to the point where it was supposed to start a bit coin gift, and rose to around $ 20,000. The current bit coin price is $ 6,350. If this is the case, the beat coin that hit the 10th birthday can be said to be negative compared to the previous year.

Could there be a cause for the explosive rise of the bitcoin, which was seen in November and December last year? On the first hand, the US Securities and Exchange Commission is expecting a bitcoin ETF approval.

Since the birth of Bitcoin, the number of passwords has exceeded 3,000. There is also the opinion that it is mostly useless. However, there is also the opinion that Altcoin, which has been selected for the next decade, will become a competitor of Bitcoin. Nigel Green, co-founder of deVere Group, a UK-based financial consulting firm, predicts bitcoin share will decline as cryptographic money becomes more commonplace, creating both more public and private digital assets.

The total market value of the current cryptographic market is about $ 400 billion. Nigel Green expects the market to expand to $ 20 trillion over the next decade. Meanwhile, Iqbal Gandham, director of eToro, an investment platform, said Bitcoin has shown tremendous strength over the last decade and has overcome volatility and has begun to deal with the problem of expandability, or scale. In addition, the next 10 years, a bit coin was a positive evaluation that it would surely exist as a means of payment and payment.

Add comment