Activision Blizzard, known for its games like World of Warcraft, is one of the most successful gaming companies in the world. Tax Watch UK, under the title of World of TaxCraft, reveals Activision Blizzard’s tax avoidance techniques.

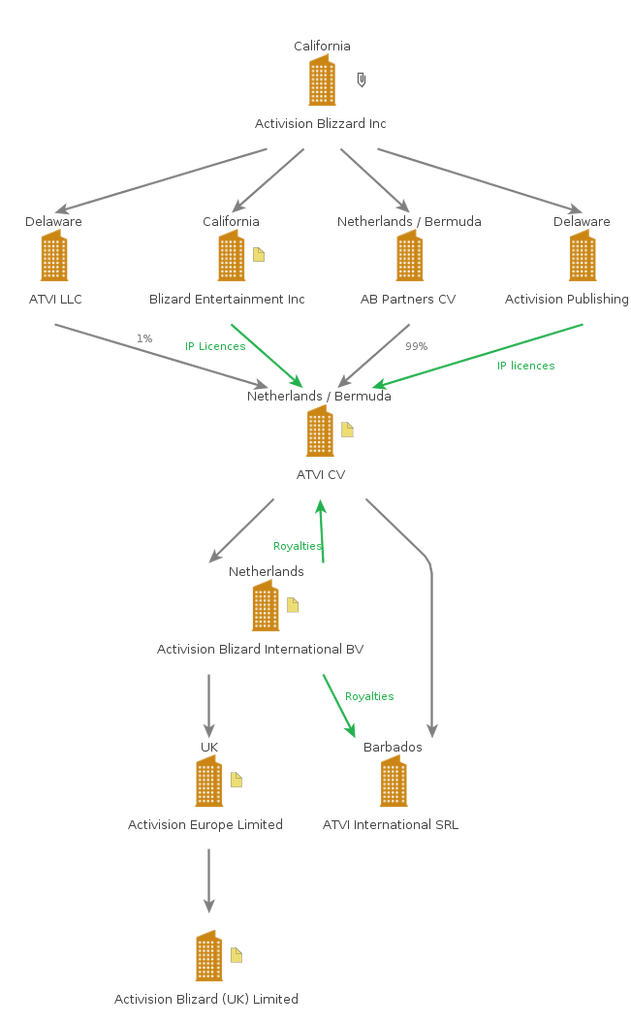

Activision Blizzard is headquartered in California, USA. However, most of Activision Blizzard’s overseas business is handled by Activision Blizzard International BV in the Netherlands. Its 2017 pre-tax profit was 565 million euros and corporate tax paid was 7.2 million euros. It was a small sum as the world’s largest game company.

The reason for this grotesque structure is that most of its profits are disappearing with royalties paid to ATVI CV, a Bermuda-based zero-employee company, and ATVI International SRL, a similar company based in Barbados.

In fact, much of Activision Blizzard’s intellectual property rights are sold to ATVI CV, and Activision Blizzard International BV is only licensed through two. In the five years from 2013 to 2017, Activision Blizzard International BV is estimated to have paid 5 billion euros in royalties to both sides.

However, this was captured by the U.S. Internal Revenue Service, and ATVI CV ordered both companies to pay an additional $1.4 billion for 2009-2016, saying that they underpaid their subsidiaries Activision Publishing and Blizzard Entertainment, and an additional $345 million was collected.

In the UK, Activision Blizzard UK is mainly responsible for Activision Blizzard’s business. Its 2017 revenue was £75 million, but its pre-tax profit was only £516,000. Activision Blizzard UK’s revenue is only a fraction of the company’s actual revenue. In fact, Activision Blizzard has announced that the UK market accounts for 12% of the company’s total revenue. Activision Blizzard UK’s revenue is estimated to be $572 million if applied to the 2017 annual revenue of $4.8 billion.

The reason Activision Blizzard UK’s profits were recorded small is because the company has been designated as a Limited Risk Distributor (LRD). LRD is a subsidiary that allows the parent company to repay business risks such as stock trading and operates under limited risk. By becoming an LRD, much of the subsidiary’s benefits can be recorded as parent company’s profits.

Here comes the parent company of Activision Blizzard UK. It is Activision Blizzard International BV. Activision Blizzard UK’s profits are not taxed anywhere since the profits here disappear with royalties paid to ATVI CVs and more.

Activision Blizzard UK describes it as an international business model, but disputes with the UK Customs Service over the flow of funds will arise. In addition, Activision Blizzard’s French subsidiary is also in dispute with tax authorities. He was ordered to pay 570 million euros for interest and fines. Activision Blizzard says it is poised to challenge the order in court.

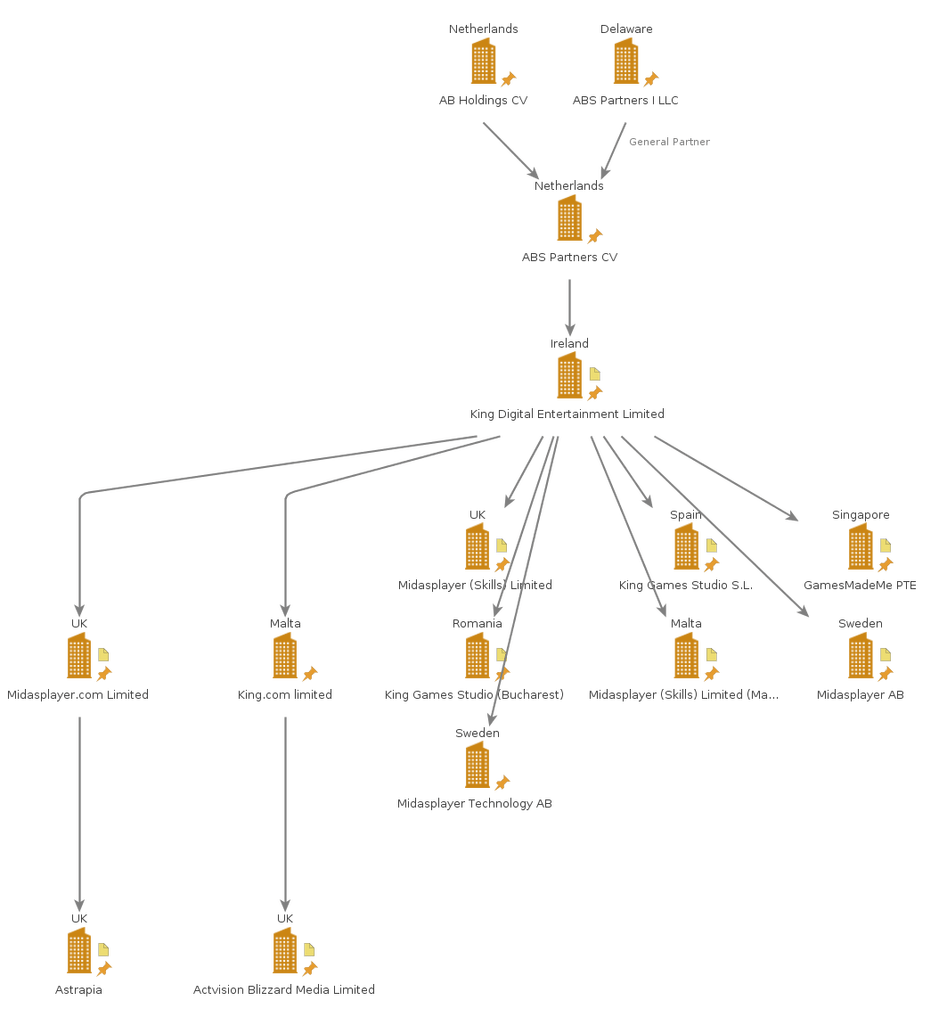

Activision Blizzard’s tax evasion technique is not the only one. Activision Blizzard acquired Swedish game maker King, known as Candy Crush Saga, a popular smartphone game in 2015, but the company is also receiving suspicion.

It is practically implemented by Midasplayer, UK, which provides management services for the King business. It posted sales of $283 million in 2017 and paid a corporate tax of $17.7 million. However, it is pointed out that this sales does not reflect the profits from consumers.

According to Candy Crush’s terms and conditions, users in the United States contract with King.com Limited in Malta, unlike King.com in Delaware. It can be seen that the amount of user payment becomes the revenue of the two companies. It is estimated that several companies in the group, including King’s headquarters, act as subcontractors for the two companies. In support of this, several tax authorities, including the UK and Sweden, are undertaking an investigation into the King Group’s transfer prices.

Transfer price is the price applied to transactions between companies within a group. If the King Group underestimated the transfer price of the service, the taxable profits in the UK and Sweden will also decline. Apart from the transfer pricing issue, there is also information that the Swedish tax authorities are claiming a $400 million tax on the King Group’s suspicious intercompany transfer of assets. Activision Blizzard says it is considering an appeal against the payment order. This could be related to the deal when King was acquired by Activision Blizzard.

TexWatch UK points out that Activision Blizzard’s entangled corporate structure is clearly designed to minimize taxation on the company’s interests. They argue that tax-free funds will exist in the billions of dollars, and that strong policy responses are needed. Related information can be found here .

Add comment