The success of start-ups is expected to contribute to future innovation and economic growth. For this reason, Korea is also strengthening its investment in start-up.

However, start-up businesses face various problems such as securing funds, securing office space, and CRM. It is a report that compiles information on start-up spending in 2018, which is an indicator to see what kind of trajectory this startup is doing. Brex, a FinTech company that provides corporate credit cards without a personal guarantee for start-ups or borrowing a deposit, unveiled the report, the 2018 State of Startup Spend Report.

One of the biggest questions to start-up entrepreneurs is how to start-up money. However, there has been no report that summarizes how startups have spent so far. Bruce says the entire startup market has decided to open up a report that outlines the overall spending trends of the entire market to create a transparent culture and create an environment where one can learn from each other to grow and accelerate their business.

To that end, Brex analyzed the start-up market trends using WiBro data, which is currently undergoing investment in start-up as well as its own data.

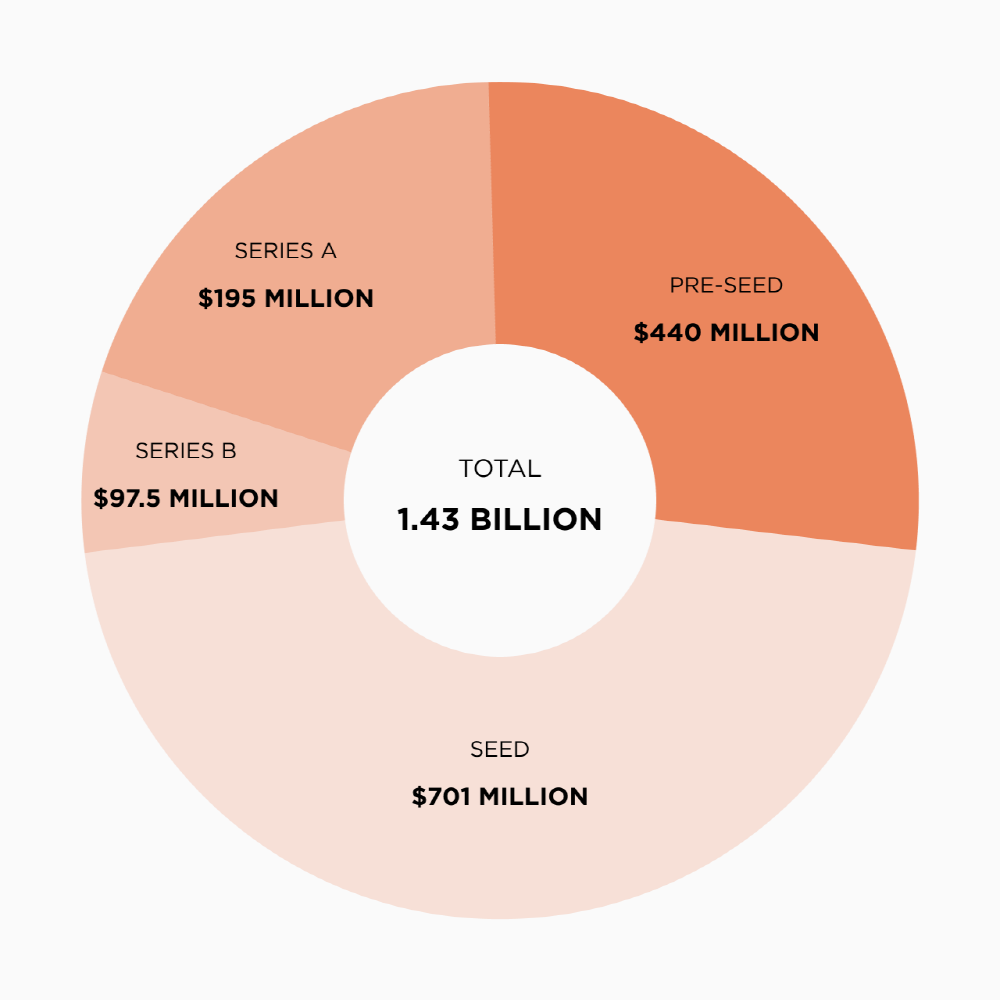

In recent years, investing in venture capital for start-ups in the so-called stealth mode, which does not disclose funding details, is increasing. According to a report on Brux’s stealth mode start-up, about $ 1.43 billion in venture capital investments is an investment in stealth mode start-ups.

More than $ 1.4 billion in funding for stealth mode start-ups, 75% of which is already in the pre-season round. If stealth mode startups are classified by industry, the top 30 percent of financing is called financial services, medical services, consumer and business software, real estate, biotechnology, and food and beverage. However, the investment in the stealth mode start-up is only 3 ~ 5% of the venture capital investment total.

According to the Q3 2018 Global VC Report, venture capital start-up investment is up to $ 8 billion at the pre-seed stage and up to $ 70 billion afterwards, while the stealth mode investment is $ 1.43 billion.

Investor Trend says that machine running and AI dominate trends, but investing in PinTech, B2B, and SaaS is taking place, according to a venture capital IVP investor in BREX.

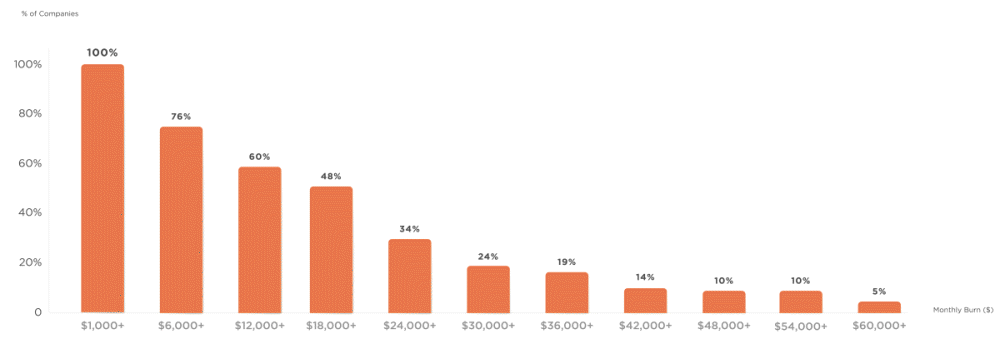

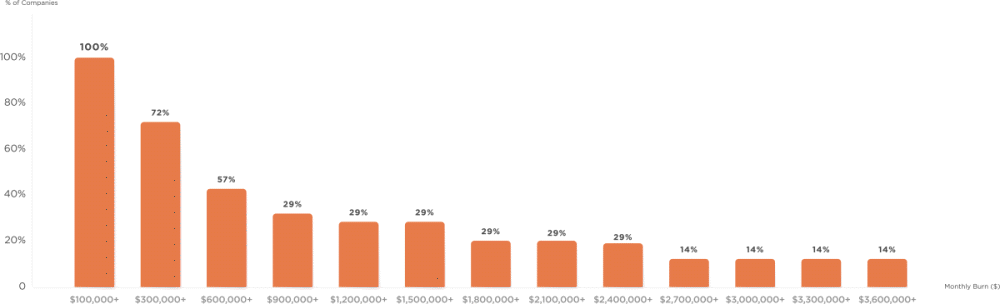

If you look at the results of an analysis of what start-ups are spending money, you can look at the amount of funding needed to start-up business management for a month. In the case of pre-seed rounds, if the funding amount is in the range of $ 1,000 to $ 5,999, the rate of return is 100%. In other words, the cost of managing the company every month is between $ 1,000 and $ 5,999.

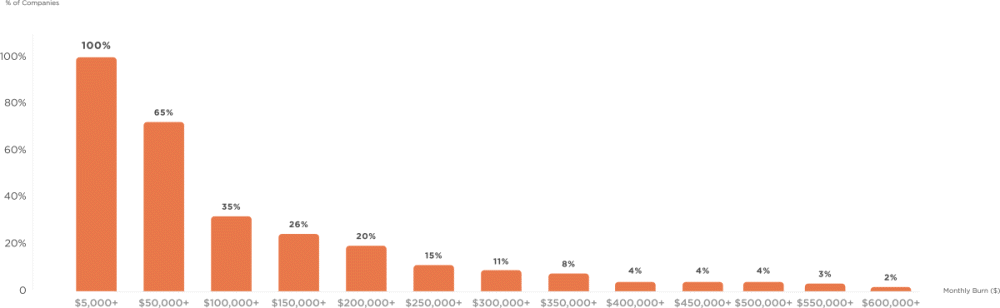

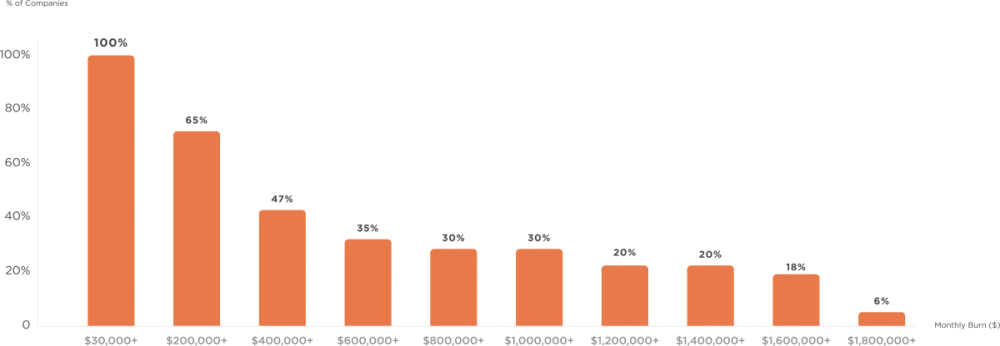

In the case of a seed round, the exchange rate is between $ 5,000 and $ 50,000. Series A exchange rates range from $ 30,000 to less than $ 200,000. The series B exchange rate is more than $ 100,000 and less than $ 300,000. In addition, the successful start-up of the investment round from pre-seed to series A and above is less than $ 450,000 from over $ 30,000.

As a result of the analysis, the Internet service, transportation, and data analysis industries showed particularly high rates of exchange rates, while household appliances, design, operating systems, and apparel industry had the lowest rates of return.

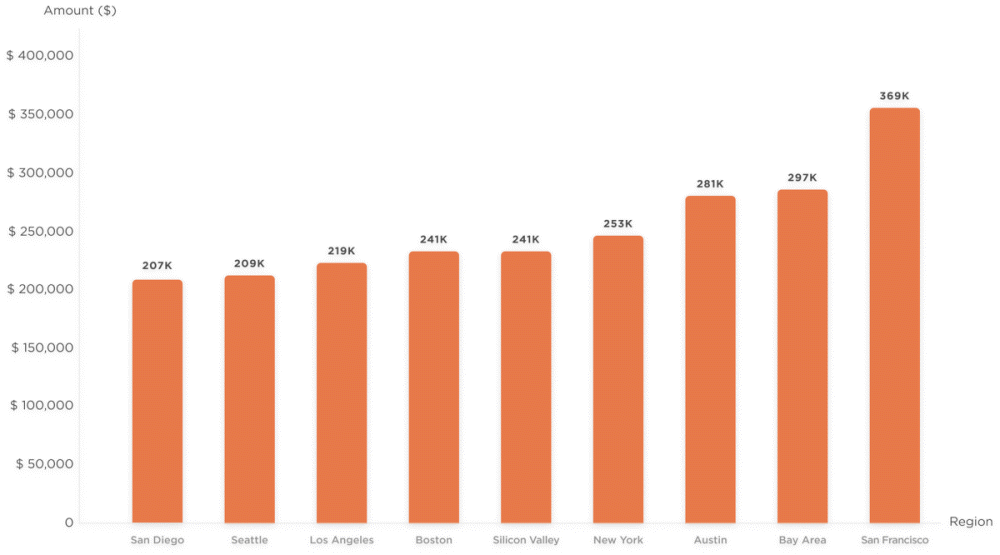

When comparing start-ups by region, the regions with the highest return-on-exchange rates are San Francisco, not Bay Area and Silicon Valley. San Francisco is the region with the most high-growth start-ups, but it has a monthly sales of $ 3.7 billion for the first month of the season, which is $ 70,000 more than the second-highest region.

Monthly spending on start-ups also includes the use of work-related management tools and services. Brux arranged the services and software that start-ups use the most. Slide sharing service is Uber (58.3%) and lift (41.7%). Work management uses Atlassian 54.5% as compared to Asana 45.5% and 60.5% of Google G-Suite than Microsoft 39.5% as a collaborative productivity tool.

E-mail marketing is 20% for HubSpot, 40% for Mailchimp, 40% for SendGrid, ERP is 83.3% for Intuit, 16.7% for Xero, Intercom) 77.8% and Front 22.2%.

The design project management was 7.7% for Figma, 30.8% for Zeplin, 23.1% for InVision and 38.5% for Toolkit, CRM was Salesforce 13%, Pipedrive 26.1 , Copper (60.9%), Cloud service (54.3%), Google cloud (20%) and Hiroku (25.7%).

Bruce says start-ups are creating their own ecosystems, while startups are investing in other start-ups to market innovative, user-friendly solutions. For more information, please click here .

Add comment